Top Image: Wikimedia Commons

A Singaporean and a German stand before the altar. They’re about to get married—though it’s a marriage of financial convenience. As Allianz slides the ring on Income’s finger, Singaporeans can hold their tongue no longer.

“This isn’t like you, Income,” Singaporeans scream. “What about us?”

ADVERTISEMENT

You know Singaporeans are worked up when an issue gets to the point of petitioning. However, concerns about the deal between income insurance and German insurer Allianz—with Allianz as the majority shareholder—have made it hard for a segment of the population to congratulate the happy couple.

From its inception, Income Insurance has always been centred around a “social mission”: to make a difference and support all kinds of Singaporeans who need insurance.

But with Allianz at a 51 percent share, online commenters seem to feel that this commitment might be up in the air. Allianz is a for-profit company after all, and the public has rightly flagged that there’s nothing stopping them from abandoning the heart of what Income’s all about.

NTUC Enterprise (NE) has tried to give their best assurances that they’ll continue championing for the people—that we’ll still have the Income that Singaporeans know and love.

Between the open letters by prominent public figures, the legalese, and the majority of online comments, it’s clear that some feel sceptical that the merged company would protect local interests.

With many just not buying the justifications, it begs the question: What’s really going on? Where are these reservations coming from?

Perhaps it’s because Income is a homegrown brand that Singaporeans know and rely on. Seeing a foreign giant take a huge bite of it has touched a sensitive nerve—or more precisely, stoked an unsaid fear of Singapore selling out.

Perhaps it’s not really about the technicalities of the deal, and there’s a deeper undercurrent of disillusionment that things existing just for the good of society are slowly becoming a relic of the past—especially now as many continue to struggle with affordability and the cost of living.

Perhaps it’s really about the fear of our social safety nets disappearing.

The Alliance With Allianz

One thing is clear: those who oppose this deal don’t believe that this new amalgamation will care about making insurance affordable and accessible.

The rhetoric so far is that Income Insurance needs to do well in order to do good. NE claims the game has changed since Income’s inception in 1970, when there were different priorities for a different Singaporean landscape.

These days, bigger corporations are taking up a slice of the Singaporean insurance pie, all of whom threaten the sustainability of a “social model”. In order to stay sustainable, NE argues that Income needs to change things up.

The public, however, remains largely unpersuaded—and that’s a problem that runs much deeper than quibbles about capital injections and shares.

ADVERTISEMENT

Firstly, it’s about the lack of faith between insurer and consumer. Insurance, more than any other industry, is predicated on trust and relationships—you want your insurance plans to show up for you in times of unforeseen hardship.

So when NTUC Income corporatised in 2022 and NE allegedly promised to remain a majority shareholder, only to reverse that two years later, it’s hard not to—as former CEO of NTUC Income Tan Suee Chieh puts it—see a resulting “loss of confidence.”

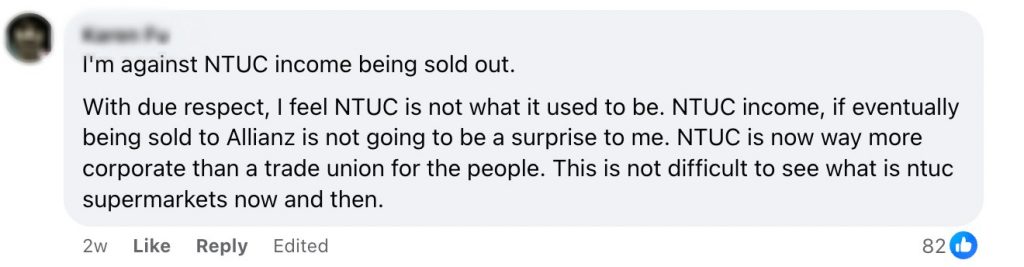

Beyond the concerns about profitmaxxing, there seems to be worries that NTUC has deviated from its original purpose. NTUC Income, and NTUC as a whole, were formed to safeguard the livelihoods of everyday Singaporeans, mitigating rising costs and protecting worker’s rights.

To be clear, it’s not as if NTUC doesn’t do any good at all. But the current outcry—driven by suspicion and disbelief—perhaps reveals a disconnect between the work NTUC does and the work the public thinks it should be doing.

It remains to be seen whether this is a gulf that can be bridged.

You Never Forget Your First

Income Insurance serves nearly 2 million Singaporeans today, a fact that speaks to the reputation that Income has established since the ‘70s. Like what Minister Alvin Tan brought up in Parliament on Tuesday, Income is a trusted brand.

“For many of us, that’s our first policy,” Minister Tan says nostalgically. We might be strangely emotional about insurance (of all things), but the fact is: you never really forget your first.

And Income has made huge strides in its social mission thus far.

Income Insurance has some pretty impressive policies that a for-profit entity wouldn’t touch with a ten- foot pole: there’s the Family Micro-Insurance Scheme which basically offers free insurance to low-income families. There’s also insurance for those with special needs, an admittedly niche market that probably doesn’t rake in much cash.

It’s precisely this good work that makes some of us fear the sale. It plays into anxieties that we’re too pro-profit; that we’re “sell(ing) our heritage” or that “nothing is sacred and everything is for sale”.

This has essentially reopened old wounds about Singapore being run like a corporation. It’s raised the question of whether we are too willing to sell anything and everything to make a quick buck.

There’s an element of nationalism here, too. Income Insurance has long been regarded as a company by Singaporeans for Singaporeans. The general consensus is that we’d rather Income hold a deal with local companies and that it doesn’t really need to sell since it was doing just fine without Germany’s Allianz.

When Parliament sat on Tuesday to unpack the deal, there was an attempt to address these concerns. Minister Tan says Income has tried to find local suitors to no avail. And that while Income might be looking fine for now, NE can’t keep feeding money into Income Insurance “in perpetuity”.

At least in the picture painted by Parliament this week, no organisation can run on public goodwill alone. Income has to pivot to stay alive, according to Minister Tan.

A Rose By Any Other Name

Even with Singaporeans hoping to manifest another SimplyGo-esque reversal, it looks like this is pretty much a done deal.

It’s understandable that some feel blindsided, while others don’t want key national assets to deviate from their original mission. In a sense, many miss the old Income—outwardly principled, altruistic, and wholly local.

But this was also an Income set up for a Singapore of the past.

Difficult decisions have to be made all the time. When push comes to shove, Singaporeans would rather have Income Insurance in their amalgamated self than not have it at all. The Monetary Association of Singapore (MAS) has tried to bandaid the situation for now, promising to hold both Income and Allianz accountable to current policyholders.

But the public backlash is real. And if NTUC and the MAS want to dispel the notion that they’re prioritising social safety over profit, they’re going to have to look beyond this Income and Allianz deal.

The key relationship isn’t between these two corporations but between NTUC and the public.

Perhaps this speaks to a deeper existential concern that Singapore has always wrestled with and—for all we know—may continue to wrestle with for a long time to come: what do we change, and what do we protect? Will there ever be an easy answer, or is the only assurance we have is that there will always be difficult compromises?

Perhaps this situation that Income has found itself in is a step towards us figuring this out.