Top image by Xue Qi Ow Yeong for RICE Media

Beset with rising living costs and a barren job market, some of us might jump at earning opportunities without a second thought. In this economic storm, a sinister undercurrent has surfaced: scammers exploiting Singaporeans seeking jobs and side incomes.

Disguised as lucrative and flexible opportunities, their schemes have not only drained victims’ hard-earned savings but also exacerbated their mounting anxieties.

You might feel indignation when reading about these deplorable job scams, and rightfully so. Seemingly genuine opportunities bait hopeful applicants, only to cast them into deeper financial turmoil.

It’s nothing short of heartbreaking when earnest optimists—reaching out for employment or an extra means of income—were handed a cruel financial nightmare instead.

They’re left grappling with debt, shame, and even thoughts of ending it all.

Pay To Play

Unlike many other carefree 24-year-olds, Leo* shoulders heavy responsibilities. Each month, he foots his family’s utility bills and pays a third of the rent, his sense of duty an anchor in their two-room HDB flat.

As a hardworking student and part-time videographer, Leo has a good head on his shoulders, and his parents deeply appreciate his contributions. Yet, behind his quiet diligence, a storm brews.

“There’s this occasional feeling of exasperation when it comes to making ends meet,” he admits, his voice tinged with regret. “And one time, I let those emotions cloud my judgment.”

The struggle is relentless. When money gets tight (and it often does), Leo finds himself scouring for ways to stretch his earnings. It was during one of these desperate searches that the trap was set.

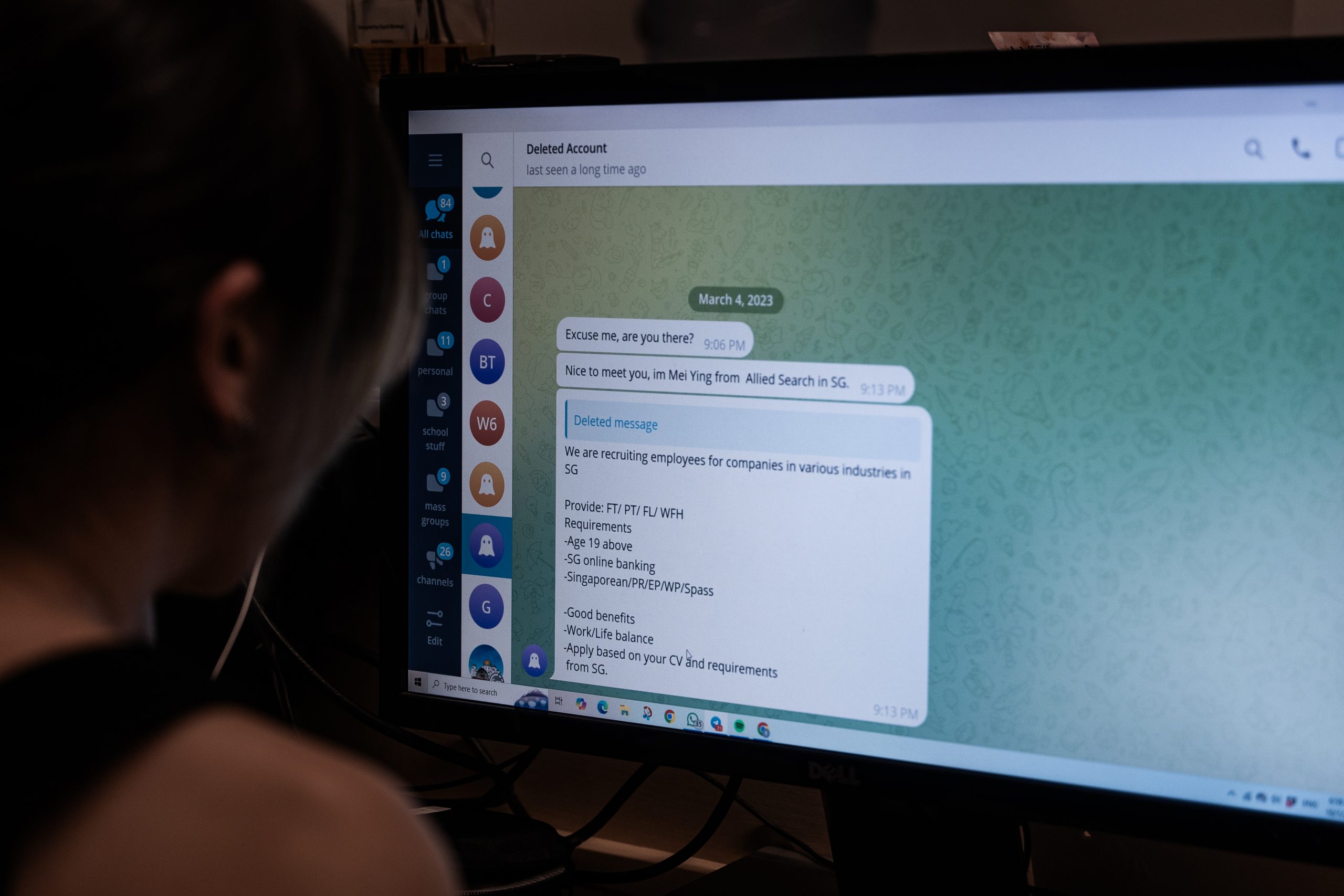

While doom-scrolling through social media, Leo stumbled upon a peculiar job advertisement: Quick cash for watching and liking TikTok videos. The promise was as enticing as it was simple, and curiosity led him into the trap.

At first glance, the brief seemed laughably easy: watch a few videos, take screenshots as proof, and pocket $10 to $15 per session. It felt like a dream—getting paid to do something millions do for free.

The poster added him to a group chat where others shared screenshots of their earnings—enticing windfalls that convinced him to get some skin in the game. When initial payments began trickling for Leo, his initial scepticism melted away.

“It was exhilarating,” he recalls, his eyes clouding at the memory. Leo presented the admin evidence that he liked and watched a few videos, and the admin wired him $30, then $40, then $50.

“I saw the money coming in, so what reason did I have to be suspicious?”

But the dream quickly darkened. The group admin, a faceless figure behind a screen, introduced an “admin fee” of $20 to $30. It was, they claimed, a necessary cost of participation.

“The admin explained that when I hit a certain ‘tier’, I can pay a fee to join a higher-paying ‘elite’ group.”

Emboldened by the initial payments, Leo wired the fee without hesitation. Then came a demand for another fee. And then another.

“I’ve got to keep the money coming in,” he remembers thinking. He bit the bullet and acceded to the admin’s demands.

What started as pocket change snowballed into a cascade of demands. $20 became $50, then $100. By the time Leo stopped to catch his breath, the latest ‘fee’ he shelled out was $350.

A gnawing suspicion crept in, so Leo plucked up the courage to confront the admin with a simple question: “Why am I paying so much just to work?”

Furthermore, he had yet to receive the recent payments owed to him.

The response to his question was swift and brutal: silence. The admin kicked him out of the chat group and blocked him.

The loss stung like a lash. For a part-time worker juggling studies and family responsibilities, losing close to a thousand dollars was devastating. Worse still was the shame that followed. Leo, usually so prudent, had been duped. How could he face his family, knowing he had lost money meant to support them?

For days, he wrestled with his guilt. The old adage rang true for Leo: “It’s the hope that kills you.” As he hung on to the glimmer of hope that he might be able to recoup his money, and procrastinated with coming clean with his family.

When he finally confided in his parents a week later, their response was unexpected. Instead of the anger he so dreaded, there was understanding—even relief.

“To my surprise, they took the news well,” Leo shares. “They said they were glad I wasn’t physically harmed and hadn’t lost more money.”

Their compassion was a balm to his bruised spirit, but the experience left a lasting scar. Today, Leo speaks out, his voice a warning to others navigating the treacherous waters of easy money schemes.

“Be wary of advertisements or being added into chatgroups promising an easy payday,” he cautions. “What seems like passive income could be a trap.”

Riddled with shame and depression, Leo is still reeling from this excruciating experience. Fortunately, there are avenues of support for victims like him. He’s found solace in confiding with professional counsellors and is gradually emerging from this expensive lesson stronger and wiser.

Restaurant Review Ruse

Tom’s* journey into the depths of despair began with a leap of faith—one that, in hindsight, he wishes he had never taken.

In his 20s, Tom had done what many consider unthinkable: quit a stable, long-term job. Burnout had left him feeling hollow, and the allure of a more fulfilling career beckoned. But when the sales job he was promised never materialised, anxiety began to seep in.

With desperation gnawing in his gut and his family’s reproach echoing in his ears, he scoured job websites for a lifeline. Then he saw it: a job advertisement saying that he could earn up to $4,500 a month for just two to three hours of remote work a day.

Looking back, Tom admits the vague job description raised red flags, but in his desperation, he ignored his instincts and seized the opportunity.

When he replied via WhatsApp to a number listed in the ad, he was swiftly contacted. He submitted his CV and the mysterious “employer” praised it.

“Our HR has reviewed your work experience, and you are qualified for this job,” they texted.

Tom eagerly accepted the offer, and his job scope was finally revealed: write online reviews for restaurants that his “boss” specified. Just a few short reviews and get paid immediately.

However, before he could start, he had to pay a $100 registration fee. Hesitant but hopeful, Tom complied, transferring the money. This should have raised red flags, but Tom’s urgency drowned out doubts.

What followed was a flurry of activity—write a review on Google Maps for a restaurant he’d never visited before, submit proof, and watch as payments of $50 to $100 landed in his bank account.

“Of course, in hindsight, this easy money was too good to be true,” divulges Tom, a bitter edge to his tone.

But the gleam of his windfall quickly took an insidious turn. His enigmatic employer began demanding increasingly significant “admin fees” under the guise of unlocking higher-paying tasks. Tom, blinded by the initial success and itching to keep the money flowing, obliged.

The fees crept upward, nibbling away at his meagre savings. When his funds ran dry, he turned to his retired mother, borrowing money that she could scarcely afford to part with.

It wasn’t until the demands escalated into the thousands that the weight of the scam fully dawned on him. Panic set in. Tom decided to report his suspicions to the police. The officers listened carefully and confirmed his worst fears: he had fallen prey to a job scam.

Simultaneously, Tom began confronting the admin in the chat group. Like Leo, he was quickly kicked out of the chat group and blocked. The game was over, and he had lost.

“I’ve always considered myself financially savvy,” Tom admits, his voice thick with embarrassment. “But I still fell for it.”

The aftermath was devastating. Tom, once a proud contributor to his family’s home loan and household expenses, found himself broke and burdened with guilt. His siblings, stepping in to pick up the slack, bore the brunt of his financial misstep. The strain on familial relationships was palpable.

Today, Tom navigates the painful journey of rebuilding his finances and repairing familial bonds.

“I’m trying to move forward,” he says quietly. “But it’s hard to forgive myself when I see the impact my choices have had on the people I love.”

Wicked Game

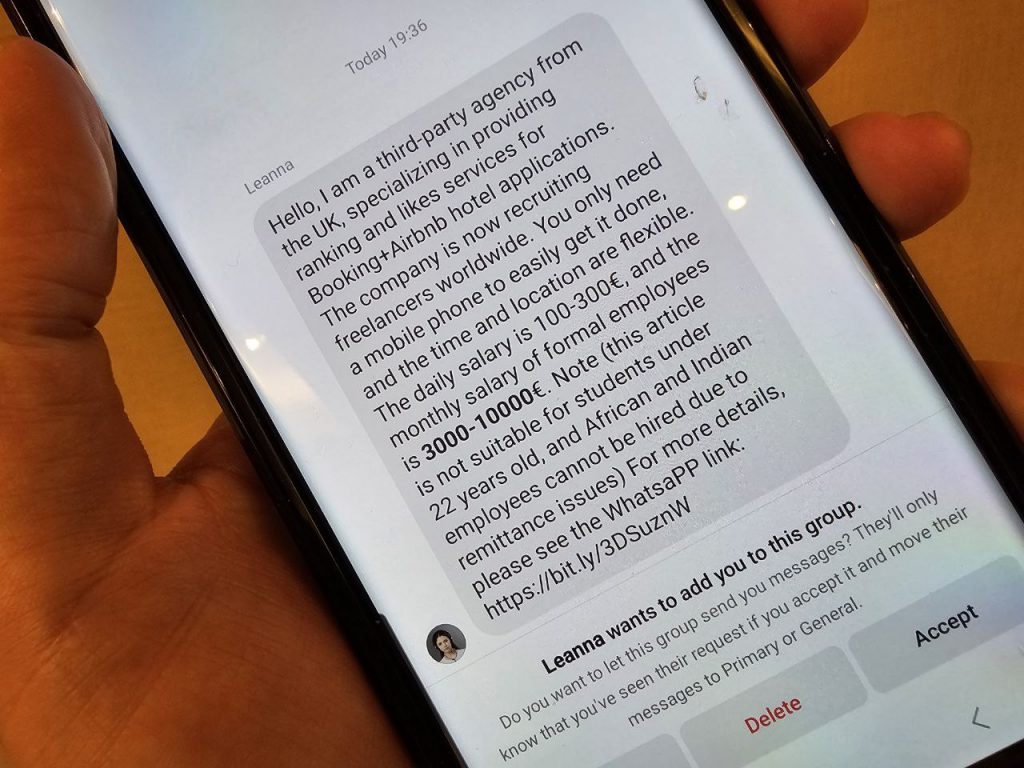

Brenda* was no stranger to the influx of unsolicited texts promising wealth or opportunity; most went straight to her trash folder. But this time, something was different. The temptation of quick money whispered to her when she was at her most vulnerable moment.

An unknown number added Brenda to a bustling chat group, in which many people were sharing screenshots of how much commission they were making.

“When I get added to these chat groups, I usually ignore them and leave,” she says, her voice quivering with regret and disbelief.

Dazzled by the dollar signs, Brenda eagerly texted the chat group’s admin to learn more about this income opportunity.

His instructions were straightforward: buy inexpensive items from online stores by transferring money to a specific bank account and get reimbursed—plus commission.

The initial purchases were exhilarating. She was asked to buy homeware and accessories that cost no more than $4 or $10, and as promised, the money flowed back quickly. She would buy a $10 makeup palette, for example, and be reimbursed $10 on top of a $10 commission.

Each ding of her phone, signalling a new reimbursement, got her adrenaline pumping. It was almost too easy. Brenda was swept into the rhythm, convinced she had stumbled upon a foolproof road to riches.

But then the stakes began to rise. The items grew more expensive, creeping into the hundreds. Brenda started to hesitate, but the effortlessness of this revenue stream drowned out her doubts. And as the price tags increased, so did her paymaster’s instructions.

Her paymaster began sending Brenda “super long and confusing instructions,” and she had to complete each task within 10 minutes. According to her paymaster, the computer system would consider her assignment invalid should she exceed the time limit. If she misinterpreted the instructions—which, in hindsight, she found highly misleading—she wouldn’t be reimbursed.

If she bought the wrong-sized product or had bought one item when the complicated instructions had specified “two”, for example, she would receive neither commission nor compensation and instead be commanded to redo the task.

When she told her family about her strange ‘occupation’, they looked at her with disbelief.

“You know this is a scam, right?”

Unperturbed, she convinced herself to soldier on.

Then came the moment that tipped the scales: an instruction to purchase $15,000 speakers. Brenda balked.

Should she? She had already “invested” just about all her life savings in this “job”.

Desperate to keep her streak going, she turned to her brother, asking if he had $15,000 to lend her. His reaction was swift and unrelenting.

“You’re being conned,” he reiterated sternly, trying to drive his point home. Brenda’s account of what had happened and the amount she was asking for had him utterly convinced that Brenda was entangled with scammers.

But Brenda couldn’t hear him. The web of deceit had ensnared her too tightly.

“If you just finish this last task, you will earn all your money back, plus commission,” texted the mysterious admin.

Brenda was penniless but anxious to find $15,000 to transfer to him.

“When my mother forced me to follow her to the police station to lodge a report, I was still convinced it wasn’t a scam.”

A few days later, while Brenda was awaiting more assignments, the “employer” who had once been so responsive disappeared without a trace. Her frantic WhatsApp messages to him were met with a deafening silence. Her calls couldn’t go through, and text messages received a single tick.

Brenda was left alone to face the crushing weight of her actions. Within her first week of “work”, she had lost more than $55,000.

“I was kind of depressed because I knew there was no way to get my money back,” she says, her gaze distant. “I feel stupid too and couldn’t believe that someone like me, who has never been tricked, fell for a scam.”

This unfortunate encounter drove a wedge between Brenda and her loved ones, who were spent from admonishing her to no avail. The emotional scars ran deeper, leaving Brenda to grapple with a profound sense of shame and a fractured sense of self.

“I don’t trust myself anymore,” she admits. “Even now, I feel the need to double-check with friends each and every time I want to make a purchase.”

Brenda’s story is a cautionary tale, a stark reminder of how scammers use social engineering techniques, leveraging emotions and capitalising on urgency to cloud anyone’s judgment. The financial loss was staggering, but it’s the emotional toll that lingers, a poignant memory that looms at the back of her mind as she works to rebuild her life.

Strength in Unity

While greed and apathy are common threads among many scams, these victims, who hail from different walks of life, were simply looking for honest ways to make ends meet.

They fell prey not because they were foolish but because they were human—emotions like hope and anguish can lead us to let our guards down.

The emotional troughs they were experiencing left them wide open, which reinforces the need for us as individuals to stop and check if we are faced with a similar situation and to constantly look out for one another.

Ingrained desires for success and validation, too, can make us easy targets for exploitation as we navigate the delicate line between ambition and caution.

What ties these stories together is a stark reminder: our shared humanity, with all its vulnerabilities, is what scammers exploit. No one is immune to deception, and these accounts are more than cautionary tales—they’re testaments to resilience and the ability to rise above mistakes.

Confronting our errors, seeking redemption, and moving forward are always within reach. But above all, these experiences urge us to pause and scrutinise anything that seems too good to be true, especially when it comes to promises of easy money.