All images from RICE file photos

The Giving Tree, by Shel Silverstein, is the most devastating children’s book you’ll ever read.

The book tells the story of a boy and an apple tree. In the beginning, the boy is content to swing from the tree’s branches, eat its apples, and sleep beneath its shade. But time goes by. The boy grows up and becomes less content.

The tree, who loves the boy very much, wants to see him happy, so she lets the boy take all of her apples to sell for money. She offers the boy all of her branches to build a house. Finally, the boy chops down her trunk to make a boat and sails away.

In the end, the tree is reduced to a stump. She has nothing left to give.

The tale is a Rorschach test. Some see it as an example of selfless love. Others see humanity’s abusive relationship with nature.

Whenever I read it, I see the parent-child relationship. The tree (i.e. the parent) gives everything it has to the boy (i.e. the child) and doesn’t get so much as a “thank you” in return. Every time I read the book, it makes me angry.

This anger, of course, is a projection of my own guilty conscience. My parents live in Taipei, and I don’t call them nearly enough, save for special occasions like birthdays or holidays. Sure, we exchange the occasional text on LINE, but amidst the distractions of everyday life, I often forget that my parents are individuals with their own dreams and aspirations, and not just satellites in my personal orbit.

Sometimes I wonder if life worked out the way they’d imagined. Do they ever regret giving me and my brother the best and most productive years of their lives? Did they have enough time to plan and think about their own future after retirement?

Or were they like the Giving Tree, where they always put themselves last?

To find out, I asked three Singaporean parents in their 30s, 40s, and 50s about their experience.

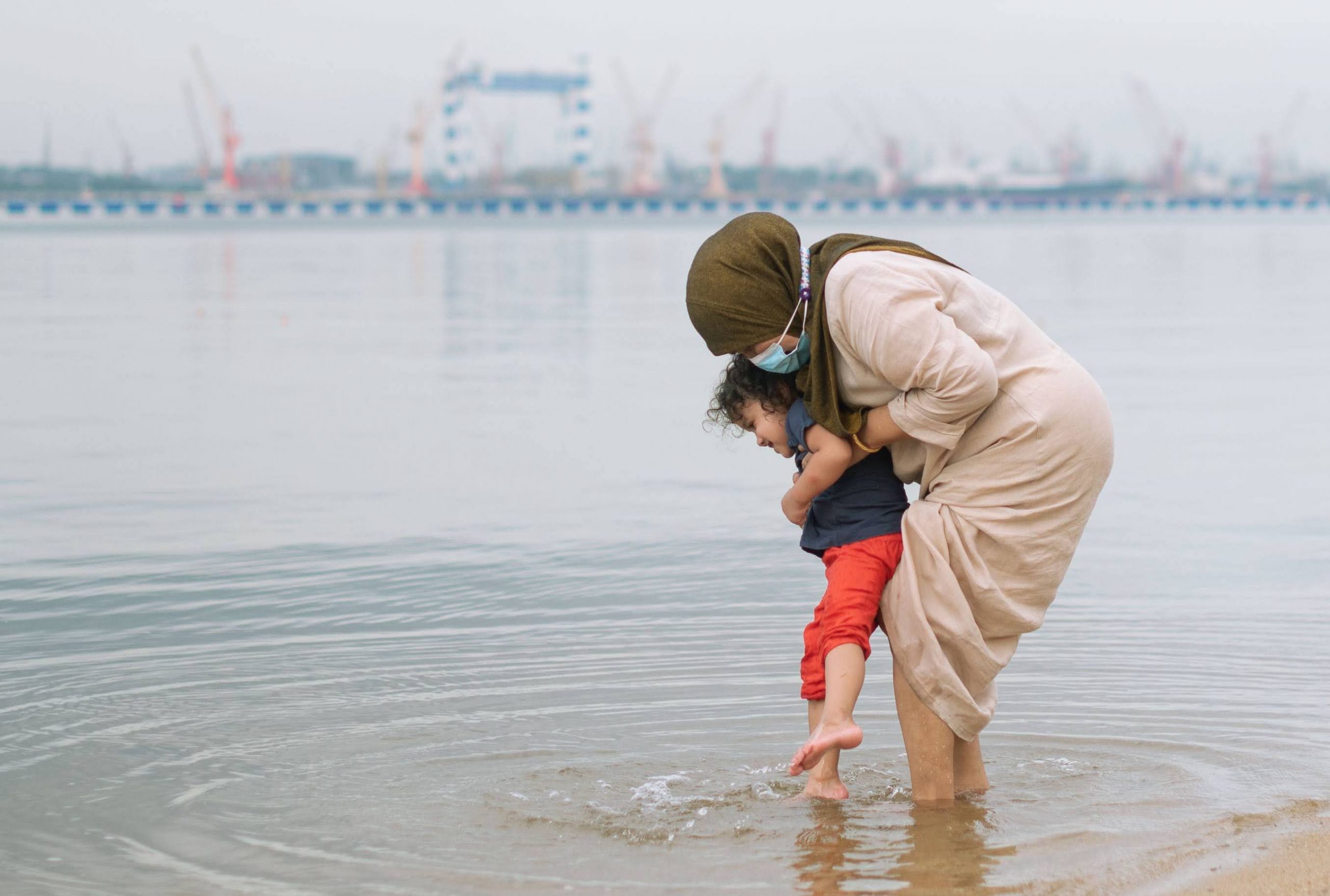

A Young Mother in Her 30s

“There were definitely moments where my husband and I would look at each other and think ‘we’re not going to make it’.”

The way Lina, describes it, the life of a young parent is a constant battle to put out small fires—glaringly so now that work-from-home arrangements are the norm. As young parents, the 33-year-old and her husband, Nick, have a daughter and a son, aged 3 and 6 respectively.

During our Whatsapp call on a Saturday afternoon, our conversation is occasionally interrupted by one of her kids screaming in the background.

“The past few months, we’ve just been responding to one emergency after another,” she explains with a sigh.

“Last month, my three-year-old developed a sudden rash that needed multiple check-ups. Amidst this pandemic, we’re also super paranoid about taking extra precautions. The cost of these unexpected expenses really adds up.”

Another taxing burden on parents during the pandemic involves the consequential impact of cautionary doctors reacting with protocol to anyone exhibiting flu symptoms. A trip to the doctor anytime their kids have a slight cough, fever or runny nose will elicit five days of medical leave — days that will require parents to manage work at home with their children.

When I broach the topic of retirement and being mentally prepared for life after kids, Lina just laughs.

“Between work and household chores, Nick and I barely have enough time to think further than the end of the week,” she says.

Then there’s the looming threat of layoffs. Nick, who works in the government sector as an accountant has at least some job security. But Lina works in marketing at a private tech company. For the past few weeks, there have been rumours of mass retrenchments on the horizon. Losing a source of income would put further pressure on Lina and Nick’s ability to service their mortgage, as well as pay for any unexpected healthcare bills. Financial planning, it goes without saying, would be vital to keep everyone protected.

“My husband and I are just trying to keep our heads above water,” she says. This, on top of having to set aside some savings for emergencies.

“Our goals for retirement right now are just to stay employed and keep on top of our mortgage.”

A Sandwich Generation Parent in His 40s

“My current plan is to retire sometime between 55 and 65 years old,” says Luke, aged 42. “But there are certainly some obstacles in the way.”

This is an understatement. Luke is part of the sandwich generation, where he and his siblings have to chip in to take care of their ageing parents as well as their own children. Luckily, Luke and his wife only have one daughter, aged 9, who is already attending school.

Unlike Lina and Nick, Luke and his siblings actually have two HDB mortgages on their plate: the remaining sum on their parents’ HDB flat — which the siblings split evenly — as well as the 30-year mortgage on their own property.

The responsibilities of the sandwich generation aren’t just limited to housing; there’s also the medical bills. Recently, Luke had to draw from his Medisave account to help pay for his father’s medical expenses.

“My parents never wanted to burden us with their remaining mortgage and medical bills,” explains Luke. “But life doesn’t always go the way you plan. My whole family has learned to roll with the punches.”

To prevent his own daughter from becoming another member of the sandwich generation, Luke has taken out hospitalisation insurance policies for both him and his wife. He’s also considering other plans that would cover a sudden loss of income.

In addition to this, he’s actively investing in a diversified portfolio of assets, which he intends to hold for the long term.

“I’ve been investing across cash, securities, real estate and savings plans, so for me, when I retire, the plan is to hopefully be able to live off my returns without drawing down my savings,” says Luke. It’s only natural that he also doesn’t want to burden his daughter in his senior years.

As with any plans, everything remains uncertain.

With Covid-19 impacting Singapore’s economy, no one knows how investments and property values will perform. And as we’re starting to learn how to live among a global health crisis—in lieu of expecting it to go away anytime soon—there are bound to be more hiccups down the road.

When I bring this up, Luke is surprisingly sanguine.

“There’s always going to be a large rebound after every crisis. I just need to be mentally prepared to stay the course with my retirement goals.”

A Frugal Entrepreneur in His 50s

“Some people can tell you exactly how much they need to retire. Unfortunately, I’m the kind of person who doesn’t really like to calculate such things,” says Oo Gin Lee, 51, an entrepreneur who runs his own PR agency. He and his wife have three children in their early to late teens.

Intrigued, I asked him to elaborate.

“For the past few decades, my family has led a very simple life. As a result, we’ve managed to pay off the mortgage on our condo,” he says.

“I’ve also accumulated a decent amount of savings, so even if I lose my job tomorrow, we will be all right at least for the next few years.”

But even that amount might not be enough to last him and his family for the years beyond, much less when he enters old age. Fortunately, Gin Lee’s frugal attitude has rubbed off on his children. For example, he and his wife provide their eldest daughter, 17, with an allowance of S$180 per month.

“She never asks for more and ends up just saving most of it,” says Gin Lee with a shrug.

His middle daughter, who’s 15, is even stranger. Her allowance is S$120 a month. Some months, Gin Lee forgets to pay her, yet she never asks him for the money.

“My daughters are like me in that sense,” says Gin Lee. “It’s good that they’re frugal and don’t have the desire to buy things, but I also worry that they’ll grow up not appreciating the value of money at all.”

As for retirement planning, Gin Lee is determined to figure it out when he gets there.

“Sometimes I wonder: will I ever want to retire? The idea of doing nothing and just relaxing with the grandkids doesn’t appeal to me. I still want to remain useful to people. I think it’s important to keep learning and growing, regardless of age.”

Is there anything he’s worried about when he hits his 60s?

“If I die, then I die lah,” he offers casually. “It’s very straightforward: all of my assets will go to my wife and children. The only thing I worry about is if I get a long-term illness. This is why I took out hospitalization insurance early on for all members of my family, which costs us around S$9,000 a year in premiums. This is our biggest expense. Otherwise, we are very carefree.”

Gin Lee’s philosophy can be summed up like this: if you take care of the bigger picture, you don’t have to worry about mapping every little detail about the future.

Preparing For Life After Children

Perhaps, like the Giving Tree, we’ll always be kids in our parent’s eyes. They’ll always prioritise our happiness and safety above their own.

At the same time, preparing for retirement isn’t a completely selfish act either. It helps to set a good example for your children so that they too can practise good habits when it’s their turn to start their own families. Planning ahead also removes a future burden on loved ones, and allows the entire family to devote all of their resources to the future generation.

You have to remember that retirement isn’t just about dollars and cents. It’s also about mental and emotional preparedness, and being in good enough health to spend your golden years in the way that you choose.

This is something that parents of all ages should keep in mind as they move through life — whether they’re in their 30s and consumed by the daily challenges of young children, or close to retirement in their 50s planning for their next chapter.

As the saying goes: to take care of others, start by taking care of yourself.