Tala, another Filipina who has been here for six years, borrowed $450 from a different licensed moneylender last year; it is located in Jurong, but she declined to say where. She was charged an interest rate of 11%. Thankfully, she managed to pay back the sum in one month.

Moneylending to foreign domestic workers in Singapore has become a hot-button issue, owing to the alarming rise in the number of workers who are taking out such loans. The discussion has raised many questions: how prevalent is worker debt? Should workers be allowed to borrow money in Singapore? And why do foreign domestic workers need to borrow so much money in the first place?

Foreign domestic workers want to splurge on their families, and so they willingly remit a large portion of their allowance on special occasions.

At that, the room, which was till now silently attentive, bursts into peals of laughter. I’m the only man seated inside, so a few mocking glances are cast my way. Self-aware, I shift in my chair, smiling deferentially.

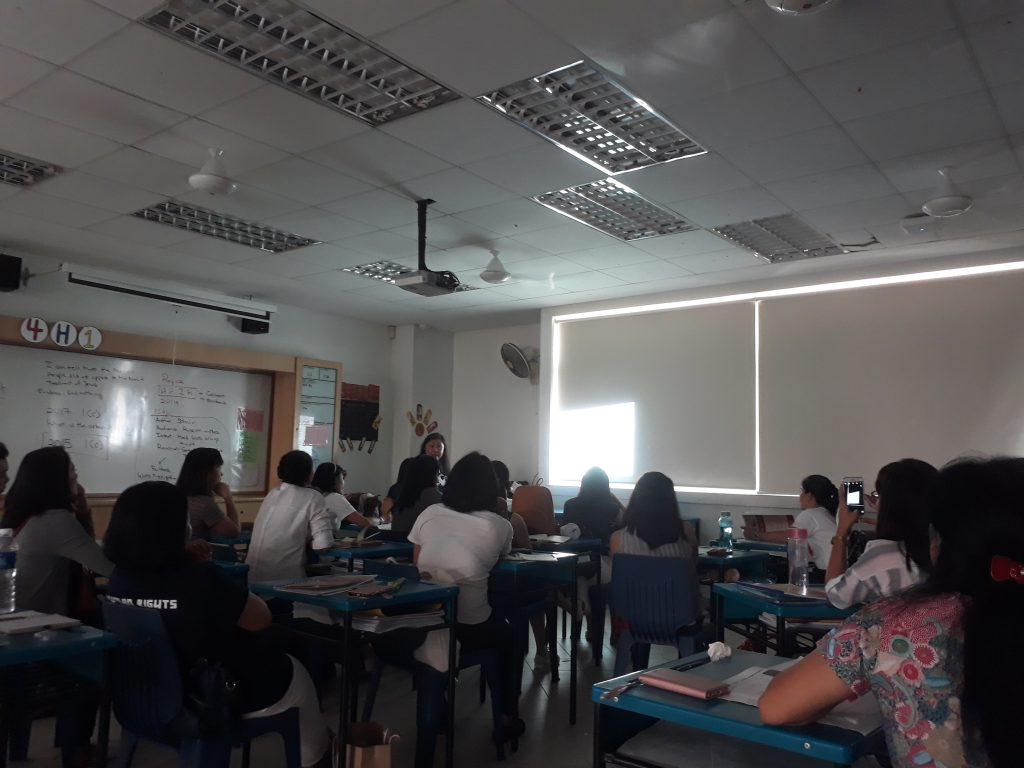

The person speaking is Saturnina De Los Santos Rotelo, known more simply as Nina ‘Cute’ Rotelo. She is a financial advisor at the Humanitarian Organisation for Migrant Economics (HOME). Every Sunday, in a deserted classroom at ACS Barker, Nina is one of several educators who teach a weekly class on personal finance to migrant domestic workers. The classes are conducted in a mix of English and Filipino, which is her native tongue.

During the lesson, Nina uses PowerPoint slides to list out the positive and negative impacts of migration. The positives seem real, tangible: higher pay, greater financial stability, and the opportunity to learn more about a foreign country or culture.

In comparison, the negatives feel floaty and insubstantial: feelings of loneliness, isolation, and resentment amongst family members.

Yet these feelings are very real. Nina tells me that many foreign domestic workers are mothers, but their absence from the home leads to numerous problems—not the least of which is the heavy toll it takes on their marriages; hence the immortal turn of phrase mentioned above (I make no claims as to the accuracy of the statement).

In Nina’s opinion, the main factor contributing to the debt situation of foreign domestic workers is a lack of financial education. Foreign domestic workers want to splurge on their families, and so they willingly remit a large portion of their allowance on special occasions, like their relatives’ birthdays.

Additionally, she says, many domestic workers also connect to their Filipino families through social media. As is the case for many people, domestic workers tend to make posts that glamorise their lives in Singapore (about food, fashion, friends), and their families watching at home want in.

For example, if a domestic worker’s son were to complain about having an older model of handphone than his schoolmates, she may take out a loan in Singapore and remit it to her family in the Philippines so that he can buy said phone.

“They never notice what they spend,” Nina says, voicing an exasperation borne of years spent teaching financial literacy, “Never think, 30 or 40 dollars, that is a thousand peso! In the Philippines, that’s 25 kilos of rice that you can eat!”

“Sometimes,” continues Nina, “The workers complain, “Why my family keep asking [for money]?” The families do not know, that’s why. You have to tell them, show them the real thing: how dirty when you clean the toilet bowl, how high is the pile of ironing … explain to the family that this is the life.”

“They feel that … that absence, they could fill it up, with enough material things,” sighs Nina.

In addition, perhaps the reason that foreign domestic workers seem unable to properly budget and plan out their finances is that they are paid so little. After all, it is already a well-established fact that poverty makes long-term decision making difficult, if not outright impossible.

At first, I expected Jasmine’s story to resemble some of the scenarios described to me by Nina. Instead, Jasmine explained that she desperately needed the money.

Back in the Philippines, Jasmine’s husband was a physically abusive alcoholic; possibly even a drug addict. After leaving with her two children, Jasmine had to come work in Singapore in order to support their education and basic needs.

Her monthly salary later became insufficient when her father fell grievously ill. In order to send her children to school and keep her father alive, she had to take out a thousand-dollar loan and remit the full sum to pay for his medical treatment.

Tala, on the other hand, needed the $450 to fix the roof of her family’s home, which had sprung a leak. While her salary would have been sufficient to pay for repairs, she had accumulated no savings prior to the leak, and was unable to finance the fix without taking out a loan.

Reflecting on this incident may have been what spurred her to attend Nina’s class in the first place.

However, even if not directly responsible, the issue of a worker’s salary is enmeshed in the other problems they may face.

A low salary might be why a migrant worker has to work in Singapore for 30 years, risking her relationship with her family, just so she can accumulate enough savings to properly care for said family. A low salary might be why a migrant worker has poverty-induced tunnel-vision; is unable to plan or save for the long term—or even fix a leaky roof.

The fact is, there are very few problems that a little more money can’t solve, and $450 a month just may not be enough for workers on whose shoulders sit an entire family.

In terms of financial planning, many foreign domestic workers are severely lacking, and regulators are stepping in to protect them. For example, new laws were passed in November last year, capping loans at $1,500 and interest rates at 4% for domestic workers, in order to prevent them from falling into serious debt.

However, this is no guarantee they won’t simply be overspending enough, or desperate enough, to turn to other ‘sources’ for loans. In fact, the spectre of illegal lending is why the government has declined to force foreign domestic workers to seek their employers’ consent before borrowing—it would drive them out of licensed establishments and straight into the jaws of loan sharks.

Beyond the regulations, and beyond the education being provided by HOME and teachers like Nina, there is one other thing we can consider to ease the financial pressure on our foreign domestic workers: simply paying them more.

Have something to say about the story? Do you think domestic workers should be paid more? Write to us at community@ricemedia.co.