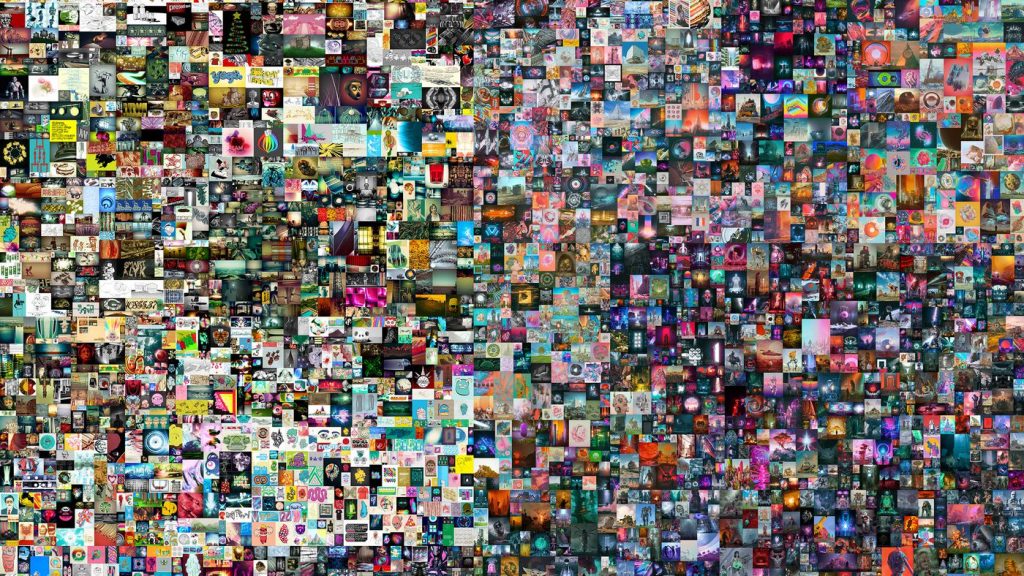

In March, Vignesh Sundaresan revealed himself as ‘Metakovan’—the mysterious buyer who purchased a digital artwork in an amount of cryptocurrency equal to USD $69 million. The artwork he purchased was an NFT (Non-Fungible Token, I’ll explain later) digital collage by Beeple: a relative unknown in the art world who had not sold a print of his work for more than USD $100 until October 2020.

For creatives in Singapore, this sale, and the opportunity to make a fortune on the digital world stage is compelling. Creating art full-time hasn’t always seemed possible in Singapore. After all, the mainstream local art-world is traditional: it revolves around galleries, buyers, curators, and exhibitions. There are gatekeepers in this process; if a work is not deemed as ‘good’ by the right people, finding representation is hard.

As such, artists who work in non-traditional mediums (for example, in digital art) don’t have a natural path to create full-time. Even the artists who work in traditional mediums aren’t exactly rolling in it. In Singapore, artists are often told to expect a lifetime of financial insecurity and a misunderstanding of their purpose in society.

This is why the recent boom of digital art, by way of NFTs and blockchain technology, is exciting and potentially disruptive. In the most optimistic view of this trend—anyone can become someone. Who needs to fuss over gallery representation and curators when there’s a captive market at your fingertips?

However, despite this alluring potential, I’m wary of preachy crypto-visionaries. Vignesh Sundaresan (aka Metakovan) announced his purchase of the Beeple piece with a dream for the future: NFTs would decentralize art, culture, and finance while fighting global imperialism.

This lofty statement from Sundaresan reminded me of Zuckerberg’s agenda for an egalitarian internet. We all know how that turned out. With public sentiment towards Facebook at an all time low, I think it’s best to meet industry leaders who sing the praises of a disruptive, trending technology with skepticism.

With that being said, I think it’s too easy to argue for or against crypto-innovation. I decided to approach this topic from a different angle instead: I created an NFT collection with a local digital artist, knowing zilch about the process or the technology beforehand. I wanted to find out if NFTs were here to stay, or just a fad.

Long story short, the RICE x The Next Most Famous Artist NFT collection sold out in 24 hours, for 0.5 ETH which is worth SGD $1,783 at press time. Here’s what I learned in the process.

Before We Begin: A Brief Explanation of Non-Fungible Tokens

A Non-Fungible Token (NFT) is a unit of data stored on a blockchain. It certifies a digital asset as unique, and irreproducible. When you purchase an NFT,you own the original, one-of-a-kind, artwork. The unit of data attached to the artwork has fiscal value, and the perceived scarcity of the art work drives the demand.

Yes, you can screenshot an NFT and post it wherever you like. But it is the data on the blockchain that makes it unique. I’ve noticed there are two kinds of buyers that explain the forces which drive hype around NFTs.

First, the art collector. Instead of asking: why do people want to buy NFTs? Instead, ask: why do people want to buy art in the first place? There are many reasons. Many of us are happy to own a print of the Mona Lisa, but for some, owning the master is a dream come true.

Often, ownership of digital art is near impossible to prove. Imagine that you created a meme which went viral and was used hundreds of times over. Who is going to believe it when you say that it’s yours? Listing that meme as an NFT would credit you, forever on the blockchain, as its creator.

The second kind of buyer is the crypto-investor. As I previously mentioned, scarcity and demand increase the value of an NFT. If you buy an artwork from an unknown artist at a low price, then suddenly the unknown artist explodes and the demand for their work soars—you’re in possession of a valuable asset.

How Is An NFT Made, And Where Is It Sold?

This article was initially pitched to my editors as a solo venture. The plan was for me to upload existing RICE content that was fairly popular or memeable, then try to sell it as an NFT.

So, I googled how to sell. The most popular way to sell NFTs is on a digital marketplace called OpenSea. ‘Minting’ an NFT—in layman’s terms, listing it for sale—requires a ‘gas fee’, which is a pay-to-play amount of Ethereum (ETH), the cryptocurrency used in transactions. In order to buy the ETH to mint the NFT, I had to get a crypto-wallet.

If your brain is spinning, you’re not alone. I gave up on the crypto-wallet. At this point I was downtrodden. There was a deadline for this piece that I wouldn’t make. The NFT world was too fussy. I keyed ‘Singapore’ into OpenSea and scrolled through all the NFT’s by local artists who, unlike me, had no worms in their brains.

Searching ‘Singapore’ on OpenSea led me to Hafiiz Karim, aka The Next Most Famous Artist. His series Visitors of Singapore, which features otherworldly portraits of classical figures in modern scenarios, had already been generating some buzz on the platform. Intrigued, and at my wits’ end, I emailed Hafiiz to see if he’d offer some advice.

The Next Most Famous Artist Is Actually Quite Famous

Hafiiz, formerly a digital art director, also thought there were worms in his brain when he ventured into NFTs—“I knew nothing about crypto. My mind would just shut down when I heard about it. The first two weeks, technically, were a pain. But once that hurdle is cleared it’s quite straightforward.”

Hafiiz cleared the technical hurdles with help from his peers in a virtual artist collective—some of the members are well versed in crypto, and were happy to help. He minted his first NFT in March, and in one month earned the equivalent of roughly SGD $20,000 in ETH.

So far, his best sellers are part of the ongoing collection: Visitors of Singapore, which first gained traction on Instagram. The series is endlessly memeable, and Hafiiz said this is its unique selling point. He elaborated: “I think as a digital artist, you must create your work with the platform you’re posting it on in mind. That’s where it lives and breathes. For Instagram, it was about making it relatable and shareable.”

Though his series was popping off on Instagram, Hafiiz wasn’t making a fortune. The NFT game has changed that. On OpenSea, where Hafiiz sells his NFTs, artists can set a percentage of residual profits they want to receive from future sales of their work.

He explained the benefits as such:

“Buyers often resell your work. The point is that I get 10% of the resales. So it was interesting that someone who bought my piece for 0.1 ETH (SGD $360) is now going to sell it at 100 ETH ($SGD 360,000). I’ll get 10% of that. The bidding culture is quite intense, and the buyers have a lot of power.”

The residual profit model is attractive for digital artists who are used to seeing their work splashed across the internet with no credit, let alone income. If you’re creating digitally anyway, why not mint an NFT on the off-chance that it goes viral?

When I asked how to go viral with our RICE NFT, Hafiiz mentioned that by this point (only a month after he hopped on the trend), attracting enough attention to garner a sale is not straightforward.

He elaborated: “Recently there’s been a saturation and surge of NFT artists joining in. Then you have to think of a way to stand out, because you don’t have a gallery or a curator to do the promotion for you. It’s all decentralized, so you still have to network and all that, which is the tough part, especially if you’re an introvert.”

Hafiiz considers himself an introvert, and doesn’t like to brag. Luckily, the members of the virtual artist collective have his back.

“The community aspect of it is really there. Sometimes we buy each other’s works, just to get the momentum going. The publicity is really important too. Because it’s so saturated, you have to go on Twitter and Clubhouse to really sell your piece. On Clubhouse, there’s a lot of rooms where buyers can get to know the artists a bit more,” he explained.

At this point in our conversation, I realized that creating a NFT as a lone wolf, with no crypto-presence or knowledge of the platform, would be a weak approach. It wouldn’t make an impact. The collaboration and skill-sharing is part of the process.

This realization inspired me to ask Hafiiz: Would you be willing to collaborate with RICE on an NFT? Thankfully, he said yes.

Creating Our NFTs

I expected the collaboration to drag on for a while, but it came together in a week. This is due to the success of Hafiiz’s Visitors of Singapore collection. Since he posts weekly on Instagram and OpenSea, he has refined the process. When I asked Hafiiz how it works, he said:

“I look for the poses and expressions of muses in historical art, then I try to do a mental photoshop of what they might be doing in modern-day Singapore. I etch the muse into a real-life scene in photoshop. ”

I asked Hafiiz to insert these expressive, historical characters in different spots around RICE HQ. I wandered around the office with our photographer Feline, looking for mundane situations that could be ironic or hilarious. Hafiiz sent over some technical specs to frame the shots, which Feline considered when she took the photos.

I sent the images to Hafiiz and he emailed the five portraits back a few days later. Then, I wrote the meme captions for each scenario on OpenSea. We called the series The Rice Office, Unfiltered—in reference to our company slogan. The process was playful, imaginative, and fun. Also, far easier than anticipated thanks to the team effort. Perhaps, there weren’t worms in my brain, after all.

And with the five portraits locked and loaded, it was time to sell.

Selling Our NFT Collection

I was worried about the sale. With Hafiiz’s prior warning on crypto-art saturation, I thought our collaboration would get lost in the noise. The dream of effortless, anonymous superstardom drifted away. To combat my fear of public failure, I devised a launch plan with our social media expert Dari: promote the collection on all RICE platforms and enlist the moderator-extraordinaire, Joel Lim, to discuss crypto-art on Clubhouse.

The night before we launched, Hafiiz posted The Rice Office, Unfiltered on OpenSea. One of the NFTs sold immediately for 0.1 ETH, or roughly SGD $363. When the collection went live on our socials, another piece sold for 0.1 ETH.

Before the Clubhouse session, I recalled a comment Hafiiz made off-handedly: “You have to go out and speak about your work. Let people be interested in your story and the concept of your collection. Then they’ll buy.”

The Clubhouse discussion was smooth—Joel is a great moderator. As Hafiiz explained the collection, two users logged on with profile pictures of our creations. When they spoke, we learned these users were our buyers.

With the buyers in the room, I had questions. Why did they purchase from our collection? What were their thoughts on the future of crypto-art, and crypto in general?

Both buyers were art lovers, based in London and Denmark. One was an architect and the other an illustrator. They were drawn to the relatability of the work, and our subversive take on the mundanities of office life.

The architect was a crypto-enthusiast. In her opinion, decentralized currency would transcend the niche market. She noted that already, banks and finance companies were incorporating crypto in their investment services. It wouldn’t be long before we used crypto for day-to-day transactions, she mused.

In response to her optimism, I mentioned a roadblock. Blockchain technology is energy-hungry. It uses large amounts of computational power to secure and authenticate transactions. Isn’t any system which relies on waste somewhat unethical? Her counter-argument was that individual culpability is a non-factor for NFT artists: they aren’t the users who require mass energy.

Speaking of roadblocks: I asked the room about regulation. Singapore has embraced blockchain, and is quite friendly towards crypto-millionaires: there’s no tax on digital capital gains. However, cryptocurrency is not a legal tender. Another NFT artist in the room said the future was bleak. He is based in India, where a crypto-ban with harsh fines is on the horizon.

After the Clubhouse room, in the wee hours of the morning, The Rice Office, Unfiltered sold out. It garnered 0.5 ETH, which is roughly SGD $1,800.

Here to Stay, or Just a Fad?

My week in the NFT world was a whirlwind. In the span of a few days, I went from knowing zilch about this realm of intangible assets, to contemplating whether its existence was a force of hope or doom in society.

On the hopeful side: I experienced the thrill of collaboration in a new medium. The possibilities of creation are ever expanding with NFTs, when the trend is viewed as a decentralized platform for artists to assert ownership of their work and make a profit.

However, I gathered that crypto-art success is not easy: with the saturation of the market, traditional tools like networking and curating have inevitably become part of the process. Hafiiz’s virtual art collective functions more-or-less like a group of curators. Elements of the old art-world have translated to the new frontier. Is all the talk of disrupting traditional gatekeeping really just hot air?

To be frank, I’m not sure that the collection would have sold on its own merit. Hafiiz has an impressive following on social media, and so does RICE. To what extent the artistry of the work matters, versus the hype that clout can generate, is unclear.

With that said, I don’t want to discourage unknown artists from trying to secure their bag on OpenSea. In fact, we’d like to distribute our share of the 0.5 ETH to budding artists who want a head start. As I mentioned earlier, there’s a gas fee, or a pay-to-play amount of ethereum required to get started.

We’d like to cover that gas fee for you. Send some of your work to community@ricemedia.co or reach out to Hafiiz on Instagram to learn more.

And finally, I’m still skeptical on whether or not crypto will be able to decentralize art, finance, and culture, as Vignesh Sundaresan proclaimed. Big corporations adopting new technology is not a promising development for decentralization. They have a tendency to homogenize. If there’s one thing I know for sure after reporting on the world of crypto, it’s this: there are definitely worms in my brain.

Are you a budding artist who wants to get in the NFT game? Write to us at community@ricemedia.co.