This weekend, Donald Trump and Xi Jinping are due to meet at the G20 summit in Osaka, in their latest attempt to pursue trade negotiations that seek an end to the tit-for-tat trade war.

What hangs on the outcome: Trump’s proposed 25% tax on all Chinese goods entering his country, a move which could severely damage both sides and the world economy at large.

With Singapore’s total trade being valued at three times its Gross Domestic Product (GDP), we are especially vulnerable to the fickle whims of global trade flows. And as the Big Two play chess with the world economy, the pawns (that’s us) scramble to survive.

As it is, businesses in Singapore are already feeling the heat. Sectors like manufacturing are especially exposed, as many goods that pass through Singapore’s ports take the form of raw materials or semi-finished products from China that are ‘value-added’ in Singapore before being shipped to the USA.

Both ends of that chain are now affected: goods from China are subjected to tariffs, leading to higher prices of inputs; the USA’s imports are now costlier, leading to reduced demand for goods and services from Singapore. Costlier materials + reduced demand = lower profits.

Consequently, Singapore’s economic forecast is gloomy: growth came in at 1.2% in the first quarter of 2019, well below the 1.5 to 2.5% predicted by the Monetary Authority of Singapore (MAS). They’re now revising their forecast—to be even gloomier than before.

While many firms are seeing reductions or outright cancellations in orders for their products, some companies view this tempest as an opportunity to procure some new sails.

For example, retailers in Singapore are now looking to tariff-free countries like Vietnam for comparatively lower production costs, part of an ongoing trend that has been hastened by the trade war. Additionally, exploring new markets like Turkey and India has given some companies the confidence to strengthen their positions in the midst of this demand slump.

While it disrupts the global supply chain, the conflict incentivises retailers to get the jump on their competitors by searching for new opportunities, something that they are taking advantage of while the storm clouds are still some way off.

But the conflict between the United States and China isn’t just about trade. It’s also about tech, and this is where consumer retailers in Singapore may begin to feel the pinch. Because in this chess match, everyone’s got their eyes on one piece:

It was an interesting label to ascribe to the world’s biggest provider of telecommunications equipment (and second-largest smartphone manufacturer), but makes clear the role Huawei expects to play in the ensuing trade war: none.

As allegations, warnings, and threats continued to be hurled across the aisle by both sides of the trade dispute, Huawei seems perfectly content to maintain business-as-usual. Consumer electronics retailers in Singapore, like Challenger and Courts, continue to stock and sell Huawei products.

But how long can it last?

This year, Trump signed an executive order allowing the US government to block its companies from buying telecommunications products from Huawei. It has also been placed on a trade blacklist, meaning that it cannot buy services or parts from US-based companies.

That’s not to say Huawei was caught unawares; in light of their rise to global dominance, they took US retaliation as an absolute certainty. To prepare for this eventuality, the smartphone manufacturer has been stockpiling chips and other parts from the United States for some time, and has created its own OS that can be operated independently of Google and its Play Services.

Perhaps this is why, even with the blacklisting, Huawei has extolled nothing but confidence. Ren Zhengfei maintains that Huawei holds a two-year lead on its 5G competitors. Huawei branches the world over are issuing assurances of uninterrupted services.

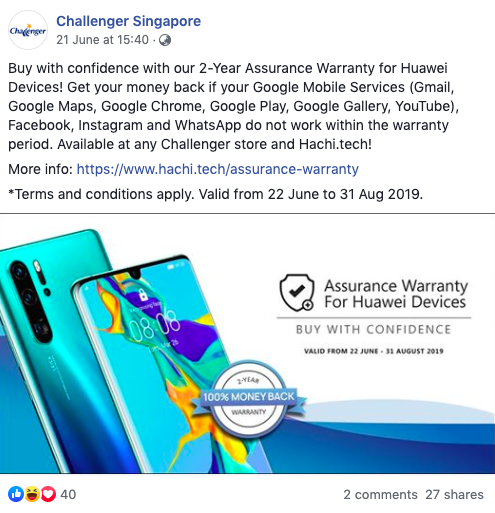

Sales of Huawei smartphones don’t seem to be slowing, maybe because retailers are offering a new consumer-minded service—the Huawei warranty. Stores like Courts and Challenger are even providing full refunds for their Huawei smartphones, in the event that Google drops the guillotine and all it’s essential services cease to function on Huawei devices. This means that Huawei users in Singapore are still able to upgrade their devices without fear of wasting their money if Google apps stop working—they’ll just get their cash back.