Indulge me in a post-Covid-19 fantasy.

It’s Sunday morning in Singapore. The sun is shining with the light of the most wanderlust-inducing Instagram filter. A husband decides to give his wife a mental health break by taking their four-year-old daughter out to the park. He sits on a bench, watching her play at a playground that’s absolutely infested with germs.

But no one breaks out the hand sanitiser and alcohol wipes. On this lovely virus-free morning, the only thing that matters is quality time between a father and daughter.

To complete this fantasy, the father decides to buy his daughter ice cream.

Should he buy from the ice cream uncle down the road or from a McDonald’s self-service kiosk?

On its surface, the father’s decision seems innocent enough. But what happens if everyone chooses McDonald’s over the ice cream uncle?

More money gets funneled into a multinational corporation and away from a local business. The ice cream uncle and the tissue auntie grow old, eventually fading from our collectively averted gaze and memory. The Golden Arches become a permanent fixture of Singapore’s landscape, much like MBS and Gardens by the Bay.

By now, you may have realised that this fantasy isn’t describing Singapore’s future, but what has already happened. Today, ice cream uncles are few and far between. Soon, they’ll disappear entirely.

This is the power of our economic choices. In our hyper capitalist and interconnected world, what we spend our money on today, is what we’ll eventually become as a society.

What the Unity + Resilience Budgets Tell Us About Singapore’s Values

In Singapore, nothing offers a better glimpse into a society’s values than government spending. After all, the government collects tax revenues from us through the tax system in the form of income tax and VATs, and redistributes this wealth to other priorities in a way that approximates the public interest.

The government also has the power to influence our behavior indirectly, by setting the rules and incentives that govern how businesses and consumers make decisions.

And similar to how a close brush with death might spark a complete reassessment of one’s life priorities, there’s nothing like the Covid-19 economic crisis to show us what a country truly values and how it chooses to express those priorities in the form of cold, hard cash.

1. Covid-19 Stimulus Part One: The Unity Budget (S$6.4 billion)

Covid-19 is a whole new beast, combining SARS on steroids with the complete economic devastation of the global financial crisis (hereafter GFC). At least during the GFC, restoring confidence in the financial markets allowed governments to slowly rebuild their economies. With Covid-19, the problem and its negative impacts doesn’t stop until we either discover a vaccine, or the virus decides it wants to stop.

When the MOF unveiled the Unity Budget on February 18, the situation in Singapore had not changed quite so drastically. The package contained the tried and tested methods favoured by policymakers: corporate tax cuts and rebates, plus an 8% wage offset through the Job Support Scheme. Yet even during this announcement, Singaporeans were already being primed for “additional measures” down the road.

Basically, the Unity Budget was like the Avengers assembling for the first time. Sure, S$6.4 billion is a lot of dough, but it all just seemed like one elaborate setup for a more expensive and highly anticipated sequel.

2. Covid-19 Stimulus Part Two: A New Resilience (S$48.4 billion)

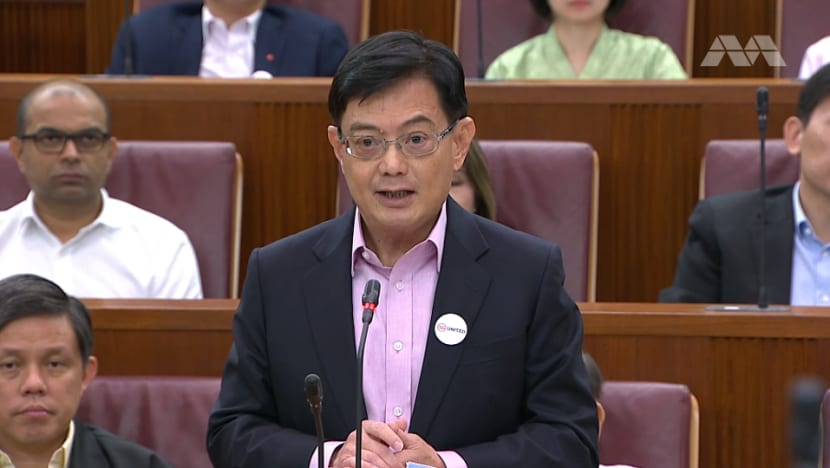

Without rehashing the entire S$48.4 billion second stimulus in tedious detail, I must admit I was pleasantly surprised by the leadership and fiscal prudence on display during DPM Heng Swee Keat’s budget speech. PR move or not, credit must be given when politicians voluntarily take three-month pay cuts in a show of solidarity.

The immediate cash payouts to families and at-risk workers to help with groceries and bills was also a welcome sign. I even had to give the government props for their forward thinking measures for the self-employed and freelancers, even as the actual implementation of who will qualify remains to be seen.

That said, the resilience budget is far from perfect in two major and critical respects:

First, the actual incentives laid out in the resilience package overwhelmingly favours employers over employees; landlords over tenants.

To quote DPM Heng Swee Keat in his second budget speech:

“Employers getting a direct 25% payroll relief through the Jobs Support Scheme are strongly urged to do their part to hold onto their workers”.

Landlords getting property tax rebates of up to 100% in certain sectors are “highly recommended to do their part to pass on the savings to their tenants”.

See the problem here? Which party is getting direct economic relief and which one is left “hoping” that the right thing will be done? I can understand employers cheering after the budget speech, but it was perplexing to watch everyday Singaporeans acting as if their jobs had just been saved.

It’s naive to count on multinational corporations to show social responsibility and national solidarity. Last I checked, these companies do not have a fiduciary responsibility to “urgings” and “recommendations”. If this downturn lasts longer than their revenue projections and spreadsheets, Singaporeans will be laid off and tenants will be turned out.

When combined with government measures that have shut down ‘non essential’ entertainment venues until April 30 (inexplicably, malls stay open), not including rental relief in the stimulus package for small tenants is like sending them into battle against Thanos, who has all six Infinity Stones. One snap of the fingers and half of Singapore’s small businesses instantly turn to ash.

I will, however, acknowledge that even as I write this, steps are being taken in the right direction. Next week, the government is expected to announce rent deferment measures for commercial tenants, placing restrictions on landlords from terminating leases due to Covid-19. But until that announcement is made, the devil is in the details. For example, a six month rent deferment for tenants, if payable in full on the seventh month, would only serve to preserve cash flow for stronger chains/players while delaying the inevitable for small, often family-run businesses.

Second, migrant workers are notably left out of the resilience budget.

Look, I get it: Singapore First. But I’m not talking about the foreign workers making absurd sums of money at Google and Facebook. I’m talking about the ones who left their families to come to Singapore to take jobs most Singaporeans refuse to do. These workers pay taxes into the system. At some point, they’ve likely waited on Singaporean families hand and foot or built the public works we’ve all come to depend on.

Some Singaporeans seem to act as if this is a zero sum game; like we’ve already reached a point where there’s only enough ventilators to save ourselves. In reality, it wouldn’t take much to include lower income migrant workers in the existing Covid-19 Support Grant, which currently provides cash grants of $S800 a month for 3 months for lower and middle income Singaporeans who will lose, or have already lost, their jobs to Covid-19.

Without including at least some migrant worker protection in this budget, the Singapore government is unwittingly offering up some twisted incentives for employers. On one hand, they’ve made Singaporean and PR salaries cheaper and more competitive through the Job Support Scheme, increasing the likelihood of migrant workers being replaced. On the other hand, they provide no additional safety net for the most vulnerable foreign workers.

With these measures, Singapore is essentially showing these workers the door.

Are we sure we want to cast a vital segment of Singapore’s population adrift without lifeboats? If so, what does that say about Singapore as a society?

What Kind Of Singapore Will Emerge After Covid-19?

Singapore is a city state that has been accused of being ‘soulless’ before, an opinion I don’t personally share (yet). But moving forward, the stakes couldn’t be higher. Will Covid-19 further exacerbate social inequality and destroy intangible aspects of local culture? Are we all just going to cross our fingers and hope that employers and landlords will do the right thing? Are the jobs held by Singaporeans and PRs truly the only ones worth saving?

In the end, it really is up to Singaporeans. In 2019, consumers outspent the government by roughly 2.5 times as a percentage of national GDP. Every economic decision Singaporeans make today has an impact on our collective future.

But in order to create the Singapore we want, mere awareness of these life-or-death tradeoffs isn’t enough. They must be translated into economic action in the form of dollars spent; actions that are a closer reflection of the values we want to embody.

Perhaps this crisis might be Singapore’s once-in-a-lifetime opportunity to address structural challenges in society like poverty and inequality, or the plight of the voiceless and most vulnerable.

To echo the glass-half-full optimism of the writer Charles Bukowski: “If you’re losing your soul and you know it, then you’ve still got a soul left to lose.”

Share your thoughts on the Covid-19 fiscal stimulus package at community@ricemedia.co.