Note: This is the fourth and concluding episode of our series on financial literacy and ETFs. Here are the first, second and third parts.

Of course, I do treat myself too. When I got my first pay cheque, I bought a Playstation 4 Slim; a chirashi bowl is my regular reward for surviving yet another month in my job.

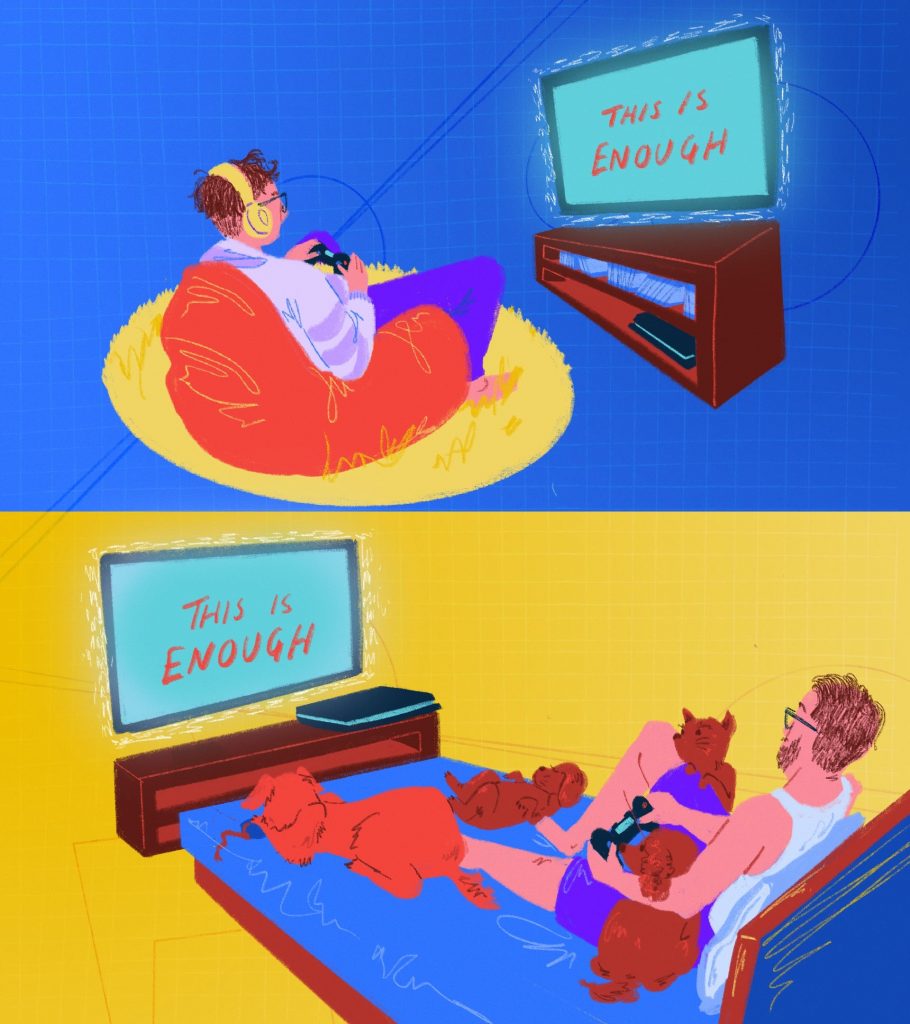

But these treats still adhere to the principle of “enough”. For example, I eschew the $10 uni add-on in my chirashi because the “plain” bowl gives me pleasure enough. To me, the slight increase in satisfaction is not worth the additional money spent.

Indeed, while our emotional well-being increases as our income rises, research done by two Princeton economists shows that “there is no further progress beyond an annual income of ~$75,000”.

For these reasons (and maybe out of sheer laziness), I have never been interested in investing my savings, despite being scolded many times by my financially savvy friends. They chastise me for letting my money rot in my bank account instead of growing in something like an ETF, for not beating inflation, for being a fool who is going to be consumed by the maws of capitalism.

These accusations are all true, but I’m uncomfortable with the idea of wanting more, because desire breeds desire. And desire, as anyone who has had an unrequited crush before (i.e. everyone) knows, makes us miserable.

So, I concluded, investments were just not for someone like me.

With that thought in mind, I started imagining possible scenarios in which I would need more than enough for myself. For instance, what if a family member needs emergency medical surgery? What if a close friend, having just lost his job, comes to me for financial help? As an average Singaporean who dumps his money into a regular bank account, I just don’t have enough to deal with these scenarios.

Ironically, these ruminations led me back to a door I had closed in the past: investments.

The question, then, is: what sort of investments are these? Even someone as financially illiterate as I am knows that there are many forms of investment one can undertake: stocks, real estate thingys, your good ole CPF SA account, derivatives (though I don’t know from what they derive) …

What I wanted was something that:

1. Doesn’t require constant monitoring because my obsessive tendencies are bad enough;

2. Doesn’t cost something like $1,000 a month because hey I’m a writer and that’s all you need to know about my income;

3. Easy to buy into because I’m lazy;

4. Easy to get out of in case of an emergency, like the release of the Playstation 5;

5. Won’t cause me to get an undercut and start approaching old acquaintances about a “marvellous new income opportunity”.

In particular, the ETFs that Nikko AM offers satisfy all the criteria that I want in an investment product. Both the ABF Singapore Bond Index Fund and the Nikko AM SGD Investment Grade Corporate Bond ETF are:

1. Simple to start investing in—I can even do it via the POSB account I’ve had since I was a child;

2. Smart, because they comprise bonds issued by the Singapore government and government-linked agencies such as HDB, all of which are definitely more prudent than I am and hence do not require my constant attention;

3. Affordable as they cost as little as $100 a month;

4. Hairstyle-agnostic so I won’t have to get an undercut;

5. Of lower risk.[1] As with all investments, there are some risks I have to take. Having said that, would I risk walking around in public with an undercut or invest in ETFs? I would go for the latter.

In fact, the ETFs are rather like the Netflix subscription I have: it’s so convenient and seamless that, till the times when I want to catch an episode of Brooklyn Nine-nine because my day sucked, I can even forget that it’s always in the background waiting for me.

But circumstances do not stagnate. This same man might start a family of four just five years later, and “enough” will mean something else entirely.

Or, to use an example less stereotypical, this aforementioned individual might decide to give up his full-time job and devote his life to rehoming stray dogs. What is enough for him, in that case, is certainly not exorbitant riches and dinners at Waku Ghin, or 5-figure tuition fees for two across 10+ years. Nonetheless, it will still involve a good deal of money and capital because feeding dogs still costs money, after all.

Similarly, what is enough investment differs according to individual situations and preferences. Truth be told, investing in ETFs might not be enough for the high roller who has millions in capital and hours to delve into the technicalities of financial jargon. But for the lazy and financially clueless (all me), ETFs are simple and smart enough for the person for whom “just enough” is enough.

With its low- to medium-risk ETF offerings, such as the ABF Singapore Bond Index and SGD Investment Grade Corporate Bond ETFs, and its relatively higher-risk, potential higher return Singapore STI Index, Nikko Asset Management Asia has the right financial instrument you need to start your investment journey.

Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of Nikko Asset Management Asia Limited (“Nikko AM Asia”).

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks’ interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be delisted from the SGX-ST. Transaction in units of the ETF will result in brokerage commissions. Listing of the units does not guarantee a liquid market for the units. Units of the ETF may be bought or sold throughout trading hours of the SGX-ST through any brokerage account. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units. Investors may only redeem the units with Nikko AM Asia under certain specified conditions.

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Nikko Asset Management Asia Limited. Registration Number 198202562H