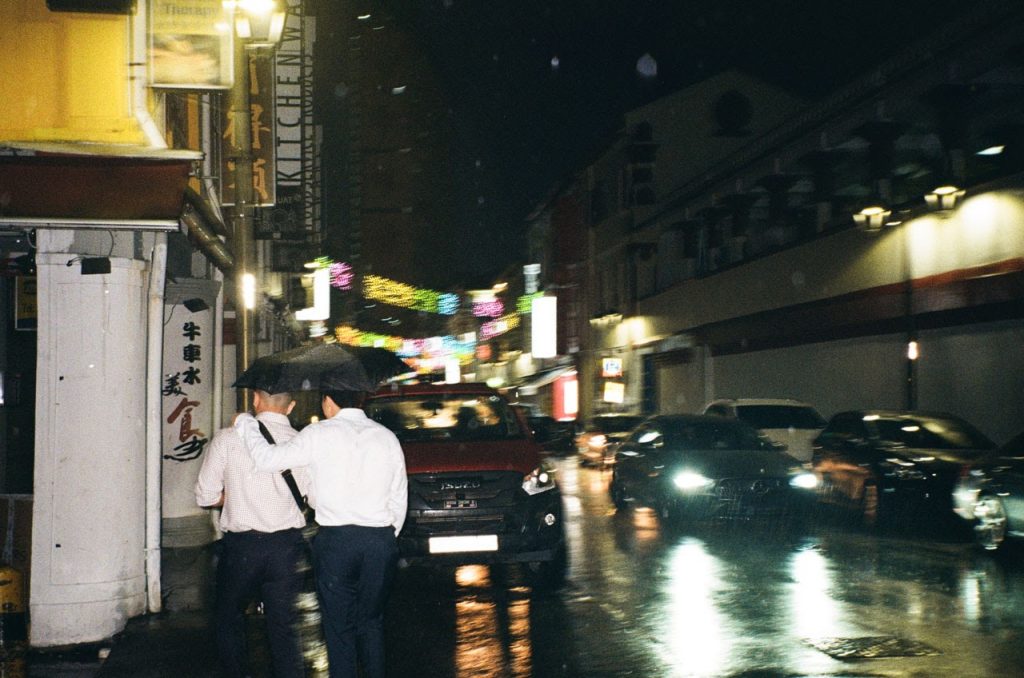

Top image: Tey Ling Jin / RICE File Photo

Besides finding out that Deputy Prime Minister Lawrence Wong pronounces ‘Hydrogen’ as ‘Hy-DRO-gen’, Singaporeans were also treated to a host of grants and vouchers on February 16th, when Mr Wong made his Budget 2024 speech in Parliament.

As always, there are sweeteners for everyone—students, mid-career professionals, young families, and the elderly. If you’re a single hoping for some help on your home-owning journey, sorry, you’re still out of luck.

Overall, ‘twas a Budget with a hard focus on workers and upskilling.

Besides the usual handouts to help households with the rising cost of living (think Community Development Council Vouchers, U-Save rebates, and service and conservancy charges rebates), there were a bunch of measures that aim to “help Singaporeans navigate the uncertainties in today’s world”, as DPM Wong said in his speech.

For one, Institute of Technical Education (ITE) graduates will receive a $5,000 top-up to their Post-Secondary Education Account when they enrol in any polytechnic diploma course. They’ll also get a $10,000 injection into their CPF Ordinary Account when they complete the course.

The “involuntarily unemployed” (i.e. those who’ve been retrenched) will be able to benefit from temporary financial assistance while they attend training and look for a new job. This is pretty big—it’s a switch-up from the government’s previous stance against unemployment welfare. More details to be ironed out later this year, says DPM Wong.

And for those above 40 who’ve been harbouring thoughts of a career switch, maybe now’s the time to start drafting that resignation letter. They’ll get a hefty $4,000 top-up to their SkillsFuture accounts. They’ll also quite literally get paid to go back to school (more on that later).

These are all worthy causes to spend money on. And we know we shouldn’t look a gift horse in the mouth. But there’s something about these generous upskilling handouts that is a little portentous.

The measures are a clear sign of rockier waters in the jobs market. We just wonder if the government’s emphasis on upskilling is enough for workers to weather that storm.

Iron Rice Bowls Don’t Exist

The budget’s underlying message is not new: mid-career switches will be the new norm. And if you’re one of the lucky ones to stay in the same job, the job’s demands are likely to change. We can no longer assume that career switches are the outliers. The idea of working in one company for life is now a relic of the past, a bygone of simpler times.

Deputy Prime Minister Lawrence Wong advanced the same message last year at the NUS IPS Singapore Perspectives Conference in 2023: “Most workers will have multiple careers in their lifetimes; even in the rare case of somebody working in the same company throughout their lives, the work they do will likely evolve over time.”

This time, however, Budget 2024 reduces the opportunity cost of upskilling. A worry for most Singaporeans is that upskilling takes away time that could have been spent earning.

Enter Budget 2024’s new training allowances.

The new training allowance applies to Singaporeans aged 40 and above. If they’re enrolled in full-time courses, these individuals are entitled to an allowance equivalent to 50 percent of one’s average income over the latest available 12-month period, capped at $3,000 per month.

Training allowances are more than welcome. But one wonders about the return on investment from attending SkillsFuture courses.

What is the percentage of Singaporeans aged 40 and above who have attended SkillsFuture Singapore (SSG) courses that have helped them switch careers?

Of those who took part in SSG’s train-and-place programmes, 56 percent in that age group managed to land jobs within six months of course completion. The jury is still out when it comes to SSG’s other programmes.

Additionally, while training allowances address the opportunity cost of time and potential earnings, some barriers to career switching remain. A successful career switch in industries might also mean a reduced take-home pay—a worry for adult Singaporeans who have bills to pay, a mortgage to service, a family to support, and a lifestyle they’re accustomed to.

We can’t expect policies to do away with all the barriers to upskilling, but it’s tough to expect that most Singaporeans will be completely accepting of the idea that upskilling is the grand solution.

When Layoffs Hit

Perhaps it is the escalating pressures confronting our workforce this year that ultimately compelled the government to overcome its longstanding reluctance towards providing unemployment benefits. It might have also prompted greater focus on training, upskilling, and reskilling in Budget 2024.

”That Singapore now has plans to introduce financial support to those who are involuntarily displaced suggests that the government anticipates that the benefits will surpass the costs moving forward,” National University of Singapore labour economist Kelvin Seah observed when the temporary financial aid measures for retrenched workers were first announced at National Day Rally last year.

DPM Wong spoke of a “messier and more unpredictable” world in his speech. Indeed, we’ve got disruptive technology advancements like artificial intelligence (AI), as well as the economic fallout from global conflicts such as the Russo-Ukrainian War and the siege in Gaza to grapple with.

Closer to home, there were several high-profile layoffs in the past year—Shopee, Lazada, Meta, Twitter, foodpanda, and Circles.Life, to name a few. And there could be more to come.

At a pre-budget media session, National Trades Union Congress (NTUC) secretary-general Ng Chee Meng didn’t mince his words. Forecasting an uptick in retrenchments in 2024, he said, “It is going to be a tough year for our workers. We are already starting to see signs, particularly with retrenchment figures doubling and wage growth stagnating, or even declining.”

It’s not a great outlook, but we certainly appreciate the honesty.

At the same time, there’s also a rising trend of long career breaks among professionals, managers, executives and technicians (PMET). And who can blame them? A Straits Times report identified push factors such as burnout and stress.

Short of offering blanket unemployment benefits or unemployment insurance (as opposition politicians have suggested in the past), the Budget 2024 measures feel like the government’s way of helping workers in the firing line for layoffs or those who’ve been retrenched recently. It’s also a signal for Singaporeans to expect more career upheavals this year.

Instead of outright handouts, they’re offering incentives for individuals to upskill and train themselves. The focus is still on self-reliance with minimal welfare.

The Unclear Returns on Investment

The value of upskilling is not lost on Singaporeans. But the supply of courses must meet rising demand.

In other words, it’s also important to have a selection of useful courses that will go some way in being recognised by employers as credible qualifications. Well, at least credible enough for employers to take a chance on a prospective employee with experience in an entirely different industry.

At the post-budget panel discussion organised by the Economics Society of Singapore, Nanyang Technological University economics professor Dr Laura Wu echoes the sentiment. There will be a need for universities or course providers to cope with the rising demand from the upcoming grants and provide “in-demand lifelong learning programmes”, she said.

For now, the need for upskilling seems to be the clear takeaway of this year’s budget. But the outcome of upskilling seems to be less so. Are one-off SkillsFuture courses really helpful to an individual’s job hunt? Or are they simply a way to ‘prove’ one isn’t sitting idle while unemployed?

To be clear, acquiring new skills is always beneficial, and there certainly are successful case studies. But Singaporeans shouldn’t expect upskilling to be a foolproof path to job security—your network, your luck, and how you sell yourself are just as important. There are other factors out of one’s control, too, like global competition and company budgets.

What’s the idea that underlies upskilling? There are different senses of this buzzword. When people speak of upskilling, some allude to switching to future-proof tech and finance industries. Others think of upskilling as a way to pick up skills that will have little bearing on their jobs or careers.

We’ve used the term so much that all the different senses of the word mix and conflate with each other. It’s now an umbrella solution for any problems in the labour market. More pertinently, there’s a deeper concern: Is upskilling the be-all and end-all answer?

Upskilling’s underlying assumption is that your job security and employability are purely based on ‘merit’ or the skills you possess. Unfortunately, that assumption doesn’t map as neatly onto real life.

Associate Professor of Economics at Singapore University of Social Sciences Walter Edgar Theseira also noted the necessity of more data on the real Return on Investment (ROI) of reskilling and upskilling programmes.

“$500 [in SkillsFuture credits] doesn’t get you very far. But is $4,000 enough to help you find a new career?”