You know, what’s the difference between someone who invests and someone who doesn’t? A S$500 steak.

You heard me. An 8-year-old aged succulent steak from one of the finest restaurants here, which poor old me will never touch with a 10-foot pole.

But that’s what my well-to-do friend treated me to for a weekday lunch. And he had the same thing two weeks ago.

Mind you, he’s only 2 years older than me. Of course, he didn’t get this wealthy from simply investing. He was someone who worked in the finance industry for years.

Still, let’s contrast the two of us. We are now working independently for ourselves. Except I didn’t work in the finance industry and am part of the financially illiterate masses.

Chances are, you are like me. You feel like me. Working in some deadbeat job, counting the hours away. What’s wrong with simple cai png lunches? Life sucks but bubble tea is my perk, okay?

Let’s not delude ourselves. To be in a position like my friend is admirable. Now we don’t have to be that rich. But who doesn’t want being able to have broader lifestyle choices without worries? That’s priceless. That’s what financial independence is all about.

So let’s stop salivating about the steak for the time being. Instead, feast on these succulent tips from my friend (let’s call him Mr Wise) which are as big and helpful as his tip to the waiter.

Tip #1 – “Don’t just focus on saving. Think Invest.”

You must have heard these golden rules incessantly by now. Save 20% of your salary. Accumulate up to 6 months’ worth of expenses as emergency savings. Move your money around banks with higher interest rates.

Oh yea, don’t eat that avocado toast. Hey, do I see you reaching out your credit card to pay that off?

In all seriousness, meeting these fundamentals is really the bare minimum. I have seen vociferous debates among colleagues about which credit card for this fancy dinner date, how to shop smartly to earn airflyer points, etc.

But Mr Wise frankly regards all these chatter as mindless and time-consuming. Yes, do find ways to spend less, but let’s use that brain to grow more notes in our bank accounts.

Because if you don’t know by now, banks generally offer you low interest rates on your deposits. Especially with Covid-19, banks have moved to cut these rates further. Even with a fixed deposit of S$20,000 to S$30,000 dollars, you are looking at 1-3% annual interest.

Dude, that can’t afford my S$500 steak.

Face it. Saving isn’t enough. So we better learn to get comfortable with investing. Play it right and conservatively, you may be able to still gain more than a measly 1%.

Especially if you truly do not have S$20,000 to S$30,000 dollars (if not…pssstt no worries, you and I are the same. Let’s jump in together).

Tip #2 – “Can’t play big? Start small and build steadily.”

In the world of investments, there are many options. You got stocks, bonds, unit trusts, equity funds, physical property, REITs. Heck, I know some guys who invest in wines and art pieces. A doctor I know spends anywhere from $10,000 to $30,000 on a single modern Chinese art piece. If you know the art of it, you can grow the value of these assets.

But if you are like me, who knows nuts about these things and doesn’t have the money to spend on branded goods, tough. You already work from 7AM to 6PM, working OT almost every other day. Maybe you have children, or you are spending your free time in the gym (which is important!). Recently, it was found that 1 in 3 Singaporeans do not invest and are not financially prepared for retirement. Sounds like you?

Let’s be honest. We may not have the time or patience to read business reports, scrutinise the business press from page to page or attending AGM meetings as it can be daunting and feel boring.

Simply put, it pays to acknowledge our risk appetite honestly. Not all of us are cut out for it. We need an option for dummies. One that has low cost entry and is transparent.

After all the hours of research into financial guide books and conversations with knowledgeable investors, including Mr Wise, I realize this: we have to consider investing in stocks. But not just stocks of any kind. Specifically Exchange-traded funds (ETFs) because “they are one of the best ways for an average person to build wealth steadily.”

Why? Simple. As I said, unless you truly have the interest to research the industry of your chosen stock, dig into the company’s financial records, track their performance over the years, it’s a foolhardy option to think you can do it by yourself. In textbook jargon, we are essentially pursuing passive investment strategies, since we can’t actively watch our investments.

Perhaps you heard of people saying just dive into blue-chip companies. There’s local companies like Singapore Airlines, ComfortDelGro and Genting Singapore which you can buy shares into. But as the unpredictable COVID-19 pandemic has shown, these businesses can take a beating when consumers stop flying, travelling and holidaying. If you aren’t stressed enough with losing your job, you will have to worry about the volatility of your investments.

Plus, I am going to show you there are some advantages to ETFs than buying stocks on your own.

You get my drift? Okay, now you are probably asking, what are ETFs?

Tip #3 – “Go low and diversify.”

The textbook definition of ETFs reads: ETFs are unit trusts that are listed and traded on the stock exchange and can hold assets such as stocks, commodities, or bonds. Investors can buy and sell the units in ETFs at market prices any time during trading hours on an exchange, just like how stocks of listed companies are transacted on the exchange.

Huh? I hear you stammer.

It’s simple. You know how they say don’t put all your eggs into one basket? Especially for investments? Diversify, diversify, diversify. You must have heard this motto cited repetitiously.

I cautioned not to invest in stocks on your own. But with an ETF, you are investing into a basket (fund) of different stocks, commodities or bonds mixed together. Why choose only chocolate when you can have an amalgamation of chocolate, vanilla, strawberry, coconut and hazelnut flavours?

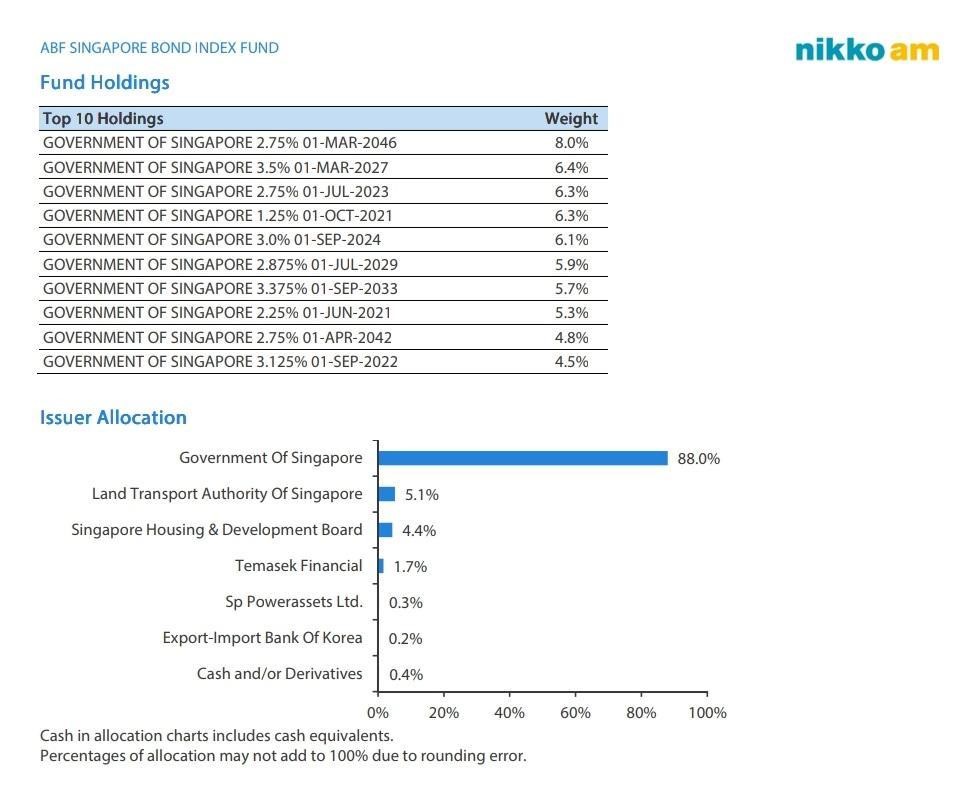

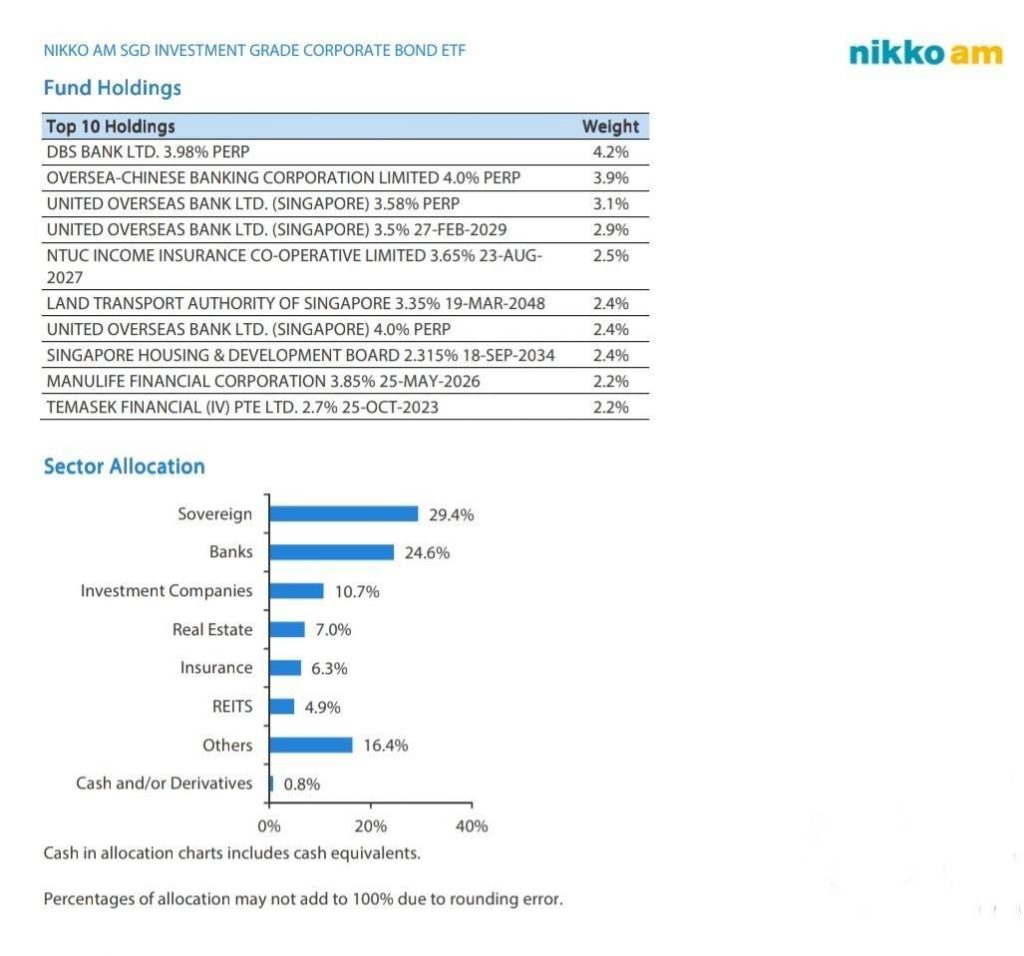

A good start would be ETFs that allows you to gain easy access to sovereign bonds, or government bonds, which are issued by governments with periodic returns and a face-value repayment upon maturity. There are also bonds offered by established institutions (ie. corporate bonds). Nikko AM’s ABF Singapore Bond Index Fund and SGD Investment Grade Corporate Bond ETF are two such examples.

The ABF Singapore Bond Index Fund primarily invests in high-quality bonds issued primarily by the Singapore government and quasi-Singapore government entities. Bonds may be viewed as a safer option than stocks because they are less volatile. And with a Bond ETF, you can diversify your investment portfolio even more with a small amount of capital.

There’s also the Nikko AM SGD Investment Grade Corporate Bond ETF, which consists of corporate bonds from established and credible institutions such as the Housing Development Board (HDB), DBS Bank, Temasek Financial and the Land Transport Authority (LTA)*.

*These names are among the bond issuers the ETF invests into as of June 2020.

Investing can be pretty daunting for a first time investor as you may be worried about which stock to invest in but Mr Wise explained to me, when you invest in ETFs, you don’t have to worry about stock picking as the ETF just invests into the stocks or bonds held by the index that the ETF invests into.

Sounds good, right? That’s why ETFs have become popular (if you never heard of this, it’s probably because nobody around you is aware of their affordability). It’s considered ideal for beginners since it has low expense fees, lower investment risk and offers a wide range of choices.

I remind you again, unless you are the sort who has money at hand to invest into the next Creative or Facebook, or afford the increasing taxes on property purchase, ETFs are generally a safer choice.

Tip #4 – “Don’t bite off more than you can chew. Budget with eyes wide open.”

Now this is where things get tricky. The options for ETFs are indeed vast. Do a Google search, and you will be swamped with ETF product advertisements from various banks. There are also private asset management firms that offer their own too. You can also choose from the list of popular ETFs, like the ones from Nikko Asset Management in Singapore.

But just like choosing your flavour of bubble tea, or the delicacy of steak, you want to weigh your options. Choosing food is easy if you already know your palate, how do you choose which fund if you don’t know your appetite for risk yet?

To make it real simple for now, Mr Wise narrows it down to two main factors—just like choosing your favourite food: budget and risk appetite.

Maybe you can only afford $100. Or $1000. If you truly can afford to, maybe $5000 to $10,000.

However, make sure it’s something you can afford without hurting your future. Whatever the amount, Mr Wise says you can “spread it the same way” because there is no minimum purchase commitment.

If a lump sum investment is difficult, you can opt for a regular savings plan, which is subscription-based. This method relies on dollar-cost averaging, i.e. the same amount of funds is used to buy more units of ETFs when prices are low and buy less when prices are high.

Simply put, by investing passively, it reduces the stress of investing as a response to market trends. You have less to worry when the markets fall and drop like a busted hot-air balloon, as you are investing for the long term.

Another advantage of investing with an ETF like the ABF Singapore Bond Index is you can tap on your CPF money to invest into it. Pretty neat huh? You don’t even have to use the money you’ve been saving for your next holiday. And unlike spending hundreds of dollars, other than using your CPF monies to invest, you can invest via a Regular Savings Plan which can start from as low as S$100 per month (not for all funds lah. But remember, this is the start).

That addresses your budget concerns. What about risk appetite? Like how you rather pay more for a nice five-course meal than cheap fast food for your partner’s birthday—you should invest with an understanding of how much you can gain or lose. Don’t forsake your relationship for a cheap bite.

Mr Wise loves his exquisite steaks and Malaysia-style curry chicken rice (which he nominated for his last meal), and advises you to approach investment based on a balance of risk and reward. You can choose McDonalds today because you are feeling good and can indulge. But when you are feeling unwell and eating junk food means receiving a medical bill in the end, why take the risk? Check the health of your finances and make regular assessments of your investments.

When you look at the various ETFs to buy from, you should look at their strengths and weaknesses under different conditions. Some ETFs stay resilient during hard times and some react accordingly to the dictates of market forces. Some will provide dividends.

Under the CPF website, you can find information on the level of risks for different investment options. For instance, as of 22 April 2020, the ABF Singapore Bond Index and Nikko AM SGD Investment Grade Corporate Bond ETF are featured as low- to medium-risk while the Nikko AM Singapore STI Index are relatively higher-risk but may provide higher returns. You may refer to the CPF website for the latest info.

If all this is confusing to you, don’t be embarrassed. There are thousands of articles out there offering different advice, when to buy this ETF or that ETF, why this ETF isn’t as good or that ETF is better. This isn’t as intuitive as knowing your appetite or your loved ones’.

So instead of spending hours sieving through all this, why not get a little help?

Tip #5 – “You are not alone. Get help. Real help.”

In the immortal words of Jerry Maguire, “show me the money!” (Has this quote outlived the millennial generation?). But money is not going to rain down by shouting into a phone so let’s see how we can be smarter about ETFs.

Now some of you may want to be like Jerry Maguire (with matching dashing looks to Tom Cruise) and you want to strike out on your own. Maybe this article makes it sound so fool-proof. It’s not impossible; there are ways to buy ETFs on your own. With countless coaching websites and books on investments, my friend supports the idea that people can work their way up.

But if you work a 60-hour job, that’s a tall order. And just like how you rely on an insurance agent to build your portfolio, it is perfectly fine to look into financial institutions to kickstart your insurance portfolio. Asset management firms can add value and help provide options for you to build your investment portfolio.

Now don’t search for any random firm that pops up from your 10-minute Google search. As any counsel will advise you, look at aspects like the track record of the institution or the profile of the fund managers. They won’t make you as rich as Warren Buffet by next year so have a reasonable expectation of their performance.

On your own, whether you use them or not, you will want to study the intricacies of ETFs. Look into aspects like the size of the fund, performance history, expense ratio, dividend distribution and other KPIs.

Especially expense ratio and dividend distribution. Since the former determines how much of your returns are eaten by expenses, and the latter determines how much and when you are getting back your returns. Show me more money, right?

In addition, don’t forget if you want to diversify your investment even further, you can consider other types of ETFs.

For instance, consider a company like Nikko Asset Management who is one of Asia’s largest asset managers and ETF provider. They provide sophisticated and diverse solutions and have a broad range of Asian-based ETFs. Heck, if you have an environmental conscience, they are certified as a carbon-neutral organisation!

Stepping into the World of Investment

If there’s one thing I may be too presumptuous about, it’s this: you are not going to get instantly rich like my friend just by investing into ETFs.

It’s not in me to pull a Wolf of Wall Street act here.

He gets to have S$500 steaks and S$200 Japanese lunches because he put his life’s work into the intricate world of investment. His portfolio consists of many other stuff that I haven’t touched on, e.g. equities, REITs, property investments.

But we all have to start somewhere. If you are someone younger, it’s not impossible to develop a richer investment portfolio eventually. If like me, time (and money) is running out because you got a mortgage and bills and a family to feed, then this is one of the best routes to start.

Like knowing your food preferences and allergies, get acquainted with your risk appetite. Look into questionnaires or have a financial adviser assess your risk preferences and design a conservative approach.

Be prudent about how much you are putting in. Nobody has ever not lost money in the world of investment. Even with ETFs, you could lose money because the returns don’t equate to the fees paid and money you have put in.

But if you are looking for a low-cost entry, invest for the long haul, and utilise many of the tips here, there’s no reason why your money can’t start growing today.

With ETFs, it’s like a secret weapon to level up your money first and fast.

And maybe one day, you can treat me to that S$500 steak.

This article has been sponsored by Nikko Asset Management Asia Limited.

With its low- to medium-risk ETF offerings, such as the ABF Singapore Bond Index and SGD Investment Grade Corporate Bond ETFs, and its relatively higher-risk, higher return Singapore STI Index, Nikko Asset Management Asia Limited has the right financial instrument you need, no matter how (expensive) you like your steak.

Disclaimer

The Central Provident Board (“CPF”) interest rate for the Ordinary Account (“OA”) is based on the 12-month fixed deposit and month-end savings rates of major local banks, subject to a minimum 2.5% interest per annum. The interest rate for Special, Medisave and Retirement Accounts (“SMRA”) is pegged to the 12-month average yield of 10-year Singapore Government Securities plus 1% per annum. A 4% per annum floor rate will be maintained for interest earned on SMRA until 31 December 2020, after which a 2.5% per annum minimum rate will apply. An extra 1% per annum interest is paid on the first S$60,000 of a member’s combined balances, including up to S$20,000 in the OA. The first S$20,000 in the OA and the first S$40,000 in the Special Account (“SA”) cannot be invested under the CPF Investment Scheme (“CPFIS”). Investors should note that the applicable interest rates for each of the CPF accounts may be varied by the CPF Board from time to time.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be delisted from the SGX-ST. Transaction in units of the ETF will result in brokerage commissions. Listing of the units does not guarantee a liquid market for the units. Units of the ETF may be bought or sold throughout trading hours of the SGX-ST through any brokerage account. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units. Investors may only redeem the units with Nikko AM Asia under certain specified conditions.

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment.You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Nikko Asset Management Asia Limited. Registration Number 198202562H