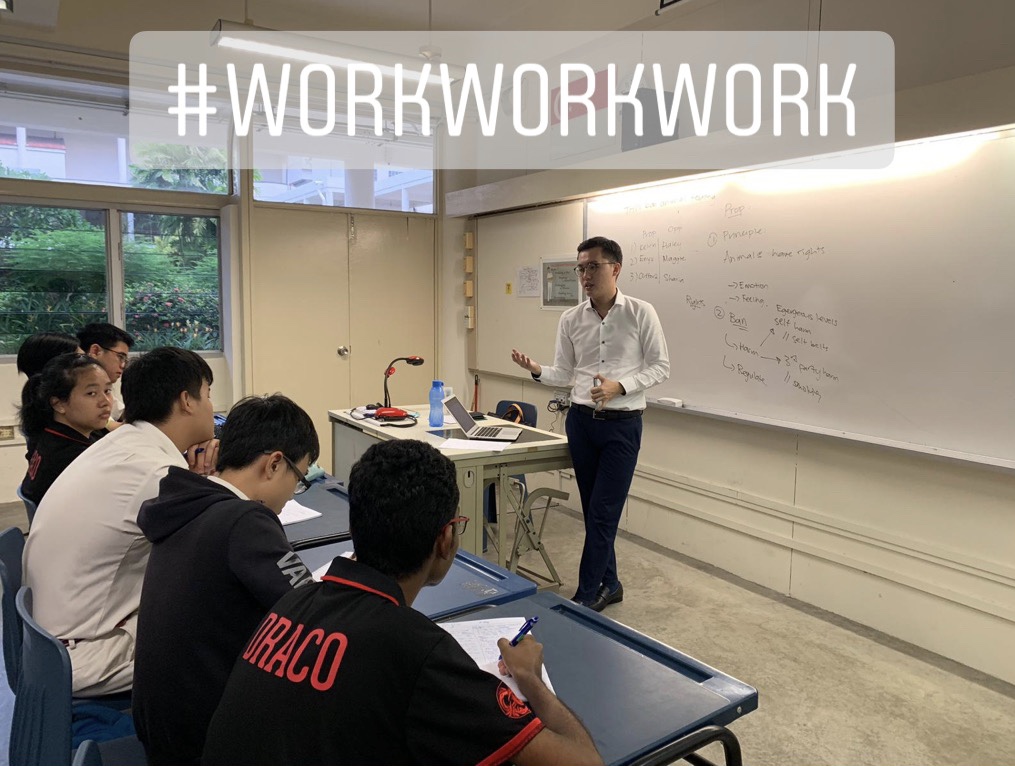

Our third intrepid spender/saver is Seah Pei Song, a 21-year-old university student who managed to save up enough money to start his own business last year. Inspired by his years as a member of his school’s debate team, Pei Song started Dialogic Learning Services, a company that provides instructors and workshops to schools for activities like debate, public speaking, and journalism.

For this instalment, we’re switching things up a little since Pei Song has already achieved his goals. Pei Song shares the 5 things he learnt about time and financial management that allowed him to be a business owner at such a young age once he was done with NS.

Age: 20

Industry: Education

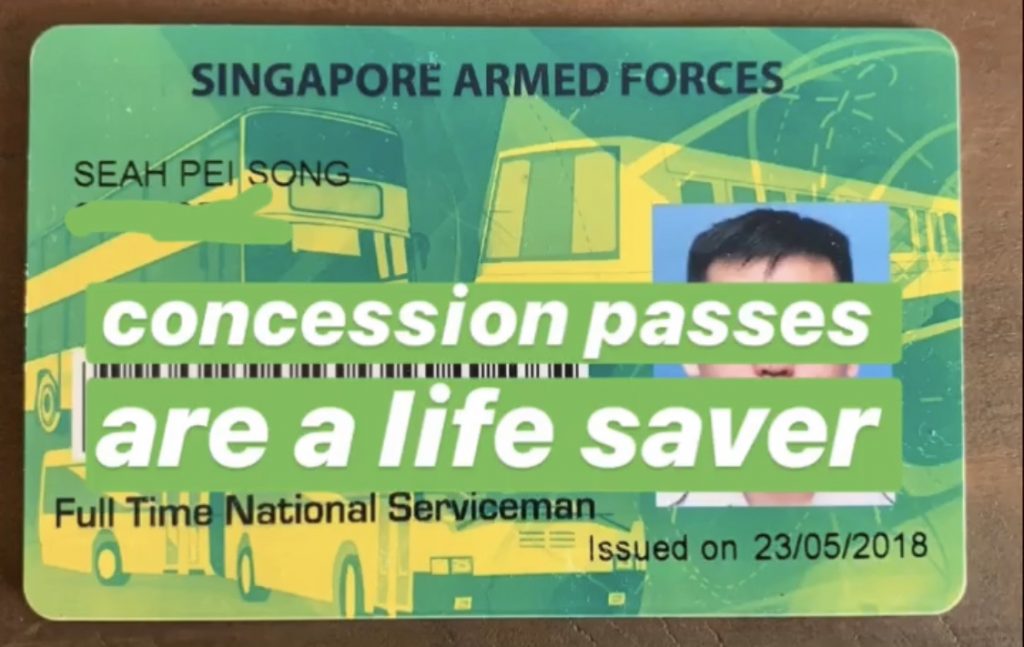

NSF allowance: $630

Goal: Save $3200 for my startup capital.

Fixed monthly (recurring) expenses:

Spotify ($10)

Public Transport ($85)

Total: $95/month, or $22/week.

Savings: At least $200/month.

What’s left (Food, leisure, etc): $335

The Challenge:

Save up enough money so that I can start my own business the moment I ORD.

When I was in the army, I had to put in a conscious effort to grow my savings because I was drawing a basic NSF allowance of merely $630 per month. I aimed to save at least $200 monthly, over the course of my whole NS, for my startup capital.

Thankfully, I was—and still am—pretty frugal. My only monthly recurring cost was Spotify Premium, which was $10 a month.

Other than that, my biggest expenses were just food and transportation. You’d be surprised by how much transport costs will add up. From Pasir Ris to Joo Koon, each journey costs about $2, one-way. That’s literally the most you can charge on the MRT. So 2-ways it’ll be almost $5!

With the fixed expenses of Spotify and my concession pass, I would only have $500 left to spend a month, so I tried to have most meals in camp.

Of course, I would make exceptions on days where the cookhouse food was not to my liking. On those days, I would spend $4.50 on Pasir Laba’s infamous ‘full battle order’: sambal cao fan with chicken cutlet, egg, cheese fries. I had it twice a month, maximum.

KOI is also a great weakness of mine. Each time I alighted the train at Pasir Ris, I would see KOI right outside the MRT station. It was a perpetual struggle resisting the urge to buy KOI.

Another thing I do to save money is when I’m at Birds of Paradise and eat the white chrysanthemum ice cream—it’s the best thing they have there—I buy it in a cup. Then I buy the packets of sui sui (crushed, fragmented) cones— the cones that are spoiled, which they then break into pieces and put into a packet.

It’s just $1. A lot cheaper than the $1.50 cone, because they give a lot more. I’ll dip the pieces into the ice cream. It gives me a lot more joy eating the $1 packet. Admittedly, it’s not that much of a saving, but when you add all these numbers together, they make $630 a month go a long way!

When I was in the army, I had a travel time of 4 hours—2 hours from Pasir Ris to Pasir Laba Camp every day, to and fro. At the start I was just using the time unproductively, like watching Netflix.

My 4-hour daily train journey turned out to be an extremely productive time that allowed me to focus on laying the foundations of my company.

Honestly, my startup capital wasn’t that much. It only consisted of admin fees for registering my company and printing materials for the workshops I conduct. In total, that added up to around $3500.

Truth be told, this is not my only company. I tried to start another before, but that failed rather miserably. I mean, the cost involved is really the cost of what could I have better used my time for. And whether this investment was something that is worthwhile.

But I told myself, even if I failed on this venture, this was my ‘business degree’. This one year trying something out, running a business, is my business degree.

Even if everything fails, this is something I would learn. I rationalised to myself that what was most important was the process rather than the result. Even if I failed a second time with this venture, I believed that the first-hand experience of running a business will be all worth it.

The benefits outweigh the costs, even opportunity costs, so I decided it’s worth pursuing.

At the start I thought that a business must be one that always focuses on the profits. I only applied for jobs that I thought I could make a big margin on. I would quote very high prices—which, unsurprisingly, resulted in me getting much more rejections than acceptance.

I started to feel like my business became a game of numbers. I was focusing too much on the money, how much I could make, how price-competitive I could be.

It was a time of introspection as I reflected on what I really wanted to achieve with my business.

My dad is a businessman. Seeing me in this state, he told me that the most important thing for any business is to always focus on what value you can add to your client, and the money is secondary. He told me that I needed to offer a service that is worth more than what they are paying me for.

Thus, I started to care less about the money and shift my focus to whatever good I could bring to the students. True enough, more contracts came along.

At the start of my business, when I was keen to gain as much experience as I could in coaching., I looked for less established schools that didn’t have a background in debating —or what they call schools in the Division 3 circuit.

The French School decided to engage me when I offered to coach pro-bono given that they didn’t have a debate coach back then. And it eventually paid off when they decided to engage me this year.

A big part of it is willing to do things for free—maybe not so much free, but with my eye less on the profit than on what I can bring to the table.

But that applies not just to running a business, but also when you are managing your time and finances. You have to do it actively.

“Pei Song is thrifty and is prudent with his spending. These are great qualities to have when you’re saving money to start your business, and you will naturally apply these practices to your business operations as well. He’s off to a good start!

Here are some nifty and affordable tips we recommend to new business owners.

1. Dream big, start small – There are advantages to starting small. You have the opportunity to learn at your own pace, the freedom to adapt to changes quickly and chart your business growth.

2. Go digital – A physical shopfront is no longer necessary today. Do your research and suss out the best tools and services online to build a digital presence. Accounting tools and business administrative services are readily available online at affordable rates as well. Check out DBS’ Start Digital portal to get the best bang for your buck!

3. Tap on the power of social media to find and engage with your target audience – Gen Z and millennials are born into the digital era, and they have social media at their fingertips. Make use of your digital and social media knowledge to grow your fan base cheaply and effectively. Be part of relevant online communities such as DBS BusinessClass to expand your network and meet like-minded entrepreneurs.”

Make your money work for you with the DBS Multiplier Account, which earns you higher interest with no minimum salary credit or card spend. Finally, keep track of all your spending (or saving!) with the new DBS Digibank app.

Have you started your own business too? What are some of your business tips? Tell us more at community@ricemedia.co